You can find our previous article on the Polish housing market HERE

The polish financial sector is experiencing drawbacks and difficulties emerging from different directions. Complexity of the global situation is still making it difficult to understand how the Polish scenario will develop, and where issues are originating from. More recently, it was the Polish banking sector to take the biggest hit – with shares plunging even by 6.3% in one trading day – as old unresolved financial instabilities re-emerge.

On this matter Bloomberg noted, before Polish interest rates peaked, that they were rising at the fastest rate in the world. Analysts at Pekao Bank announced that 10-year bond rates had risen by more than 300 basis points during the month. Bloomberg then quoted Viktor Szabo, a London-based money manager at Abrdn Plc, as saying that “Poland’s combination of fiscal and monetary policy is absolutely inappropriate for the current atmosphere, destructive to markets and inflationary”.

Yields have normalised as Polish Prime Minister Mateusz Morawiecki sought to reassure investors about the lack of a firm response to inflation, which is at a 25-year high. He stated that the country’s fiscal policy would be aimed at curbing inflation and pledged to rein in an expansionary fiscal policy.

Poland intends to seek funding from sovereign wealth funds and foreign currency bond sales to ease pressure on the local market as borrowing costs soar but has yet to set a target for how much it hopes to raise overseas, the person added. The ministry declined to comment.

Poland tapped foreign markets with a double-tranche (10Y/20Y) Eurobond offering that attracted significant demand for €13bn, of which Poland accepted €3.5bn. According to MinFin, Poland has already completed 57 per cent of its planned Eurobond issuance for this year and the next foreign bond is planned in USD or possibly JPY. This growth has already had a significant impact. In October last year, Poland’s development bank, BGK, cancelled its planned bond sale when interest rates rose sharply, increasing the cost of debt to the state. The proceeds were to be used in part to support the armed forces at a time when Poland is trying to increase its defence budget in response to Russia’s invasion of neighbouring Ukraine.

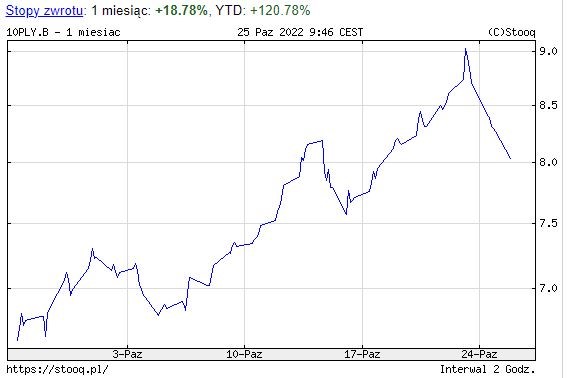

Poland’s 10-year bond yields rose above 9% for the first time in more than 20 years as investors demanded a higher risk premium amid rising inflation, the possibility of losing billions in EU subsidies and the central bank’s unexpected decision in October not to raise interest rates.

Polish 10-year bond yields over the month. Source: stooq.pl

In line with the European norm, Poland will soon experience stagflation

Are we witnessing a “debt crisis” (remember, this is relatively manageable for now) or is the debt crisis a symptom of a more fundamental problem in the Polish economy?

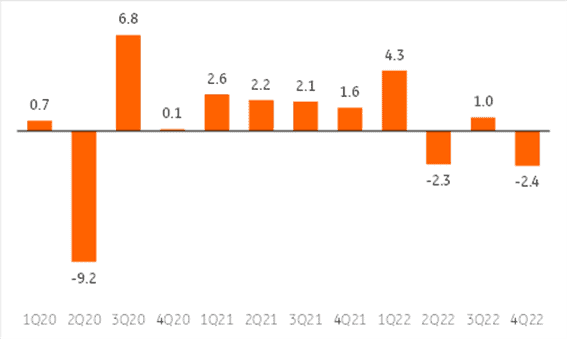

GDP fell by 2.4% qoq in Q4 2022 (SA, flash estimate), after rising by 1.0% qoq in the previous quarter. The start of 2023 will be challenging, but we expect the economy to expand by 1%, driven mainly by net exports. The composition of GDP should favour deflation, although price growth is expected to remain robust.

According to the flash estimate (seasonally adjusted statistics), Poland’s GDP declined by 2.4 % quarter on quarter in the fourth quarter of 2012, after a quarterly increase of 1.0 % in the third quarter. Quarters of rising activity were interspersed with quarters of falling activity in 2022. Annual growth slowed to 2.0 per cent in the fourth quarter from 3.6 per cent in the previous quarter. Based on the statistics for 2022 and previously published quarterly data, we expect household consumption to have fallen by around 1.5 per cent year-on-year in the fourth quarter of 2022, while investment will have risen by more than 5 per cent year-on-year. Both changes in inventories and net exports make a positive contribution to annual growth in the last quarter of 2022.

The decline in inflation throughout 2023 and the current improvement in inflation expectations are the result of the reversal of two major shocks, namely pandemic and war/energy. Domestic inflation projections remain weak. We highlight many compelling arguments against rate cuts in 2023: (1) At the end of 2023, core inflation should still be well above target. (2) Historical experience suggests that it is easier to reduce inflation from 20% to 10% than from 10% to 2.5%. In the fourth quarter, the reversal of supply shocks, which are ultimately beyond the NBP’s control, should bring the CPI down to single digits. Moreover, the structure of inflation at the end of 2023 suggests that high core inflation is a threat to price stability, as it reflects domestic demand pressures, and lower CPI may require more painful measures to reach the 2.5% yoy target; (3) Poland has a very strong labour market despite the GDP slowdown, with a record number of companies planning to raise wages; and (4) we see an overhang of high energy prices.

The latest current GDP numbers reflect a continuation of Poland’s economic deterioration. Beginning 2023 will be hard. Our most recent estimate for the annual GDP decline in the first quarter is about -1 percent, as opposed to the -2 percent YoY we had previously predicted. The severity of the energy crisis in Europe is far less than anticipated, and commodity prices for energy have reduced drastically. We estimate a one percent increase in the economy in 2023. Since forecasts in the 0-0.5 percent range were widespread until recently, the market consensus is likewise turning in this direction.

High inflation has a negative effect on consumers’ actual disposable income, resulting in lower expenditure. As a result, higher lending rates and lower prospects for local and global demand are hurting enterprises’ investment strategies. Nonetheless, the public sector may stimulate investment activity in 2023, particularly military spending, which will simultaneously reduce imports.

As domestic demand diminishes, we expect net exports to be the dominant driver of GDP growth in 2023. This mix of growth should be favourable to deflation, but we expect price increases to be driven mostly by costs and not by demand. In 2023, we still foresee a double-digit increase in consumer prices and continuously high core inflation.

It is anticipated that the inflation rate would continue to grow until the summer

On the 9th of February, the president of the Bank of Poland, Glapiski, reaffirmed his earlier forecast that inflation will increase in January and February. In addition, he said that inflation remains elevated, but that its average level in the first quarter will be lower than the NBP projected in its November projection. Energy expenses, according to the NBP, are the principal source of the current high inflation. Moreover, the price increase is extending to other components of the inflation basket, resulting in an increase in core inflation.

President Glapiski indicated that the global economic situation is deteriorating and that the world economy’s gross domestic product (GDP) growth in 2023 would be significantly lower than in 2022. The drop is due to rising energy and commodity prices. Concurrently, the likelihood of gas shortages in Europe has decreased substantially. The most terrible predictions have not materialized, and the economic outlook for Europe has somewhat improved. The global rate of inflation is in fact still excessive, but it has begun to decline in a few nations. The decline in inflation is attributable in part to relieving tensions in global supply networks, falling commodity prices, and diminished market demand. Inflationary pressures are mitigated by the declining buying power of companies and enterprises.

After the first quarter, Glapiski forecasts a substantial decline in inflation to about 8 percent in the fourth quarter on average. According to the president of the NBP, annual headline inflation might fall to 6% in December, which would be close to levels that consumers seldom notice. Glapiski highlighted that this is not the ultimate policy aim, and that in following years the NBP would attempt to bring inflation as near as possible to 2.5 percent (NBP official target).

The NBP president remarked during a news conference that the current level of NBP interest rates (6.75 percent) is sufficient to accomplish the inflation target. Moreover, he reiterated several times that it is too early to contemplate rate reductions and that the Council has not yet completed its cycle of rate rises, not least since the behavior of prices in January and February remains uncertain. In addition, he stressed that the NBP’s inflation target is 2.5% plus or minus one percentage point.

The remaining material about the NBP’s inflation objective was vague and unclear. The NBP president has stated several times that single-digit inflation is acceptable. Moreover, he underlined that governments wishing rapid GDP growth must be tolerant of higher inflation. This letter shows, in our opinion, that a fall in CPI inflation alone, even if core inflation stays persistently high, might be sufficient to persuade the Monetary Policy Council to launch a debate on cuts. According to Glapinski, this issue may receive greater attention in the months of May or June. The possibility that the first-rate cut will occur before the end of 2023 is increasing.

Polish banks and older difficulties

There may be a relationship between the debt crisis and banking sector problems. The shares of Polish banks plunged on February 16 when Advocate General Collins of the Court of Justice of the European Union declared in a non-binding judgment (Case C-520/21) that banks cannot seek payments in excess of the principle repayment on contested Swiss franc mortgage contracts.

Collins stated, however, that ultimately it will be up to Polish courts to determine, by reference to national law, whether consumers have the right to pursue such claims and, if so, to determine the merits of such claims. His position is based on the EU regulation against unfair terms in consumer contracts, which aims to give a high degree of protection to consumers. The advocate general noted that banks should not profit economically from a position they created by their own unlawful behaviour.

The Association of Polish Banks (ZBP), a banking lobby, responded that the CJEU is not compelled to adopt the judgment of the advocate general and that the prior CJEU decisions contradict the advocate general’s conclusion.

During afternoon trading, the WSE’s blue-chip index, WIG20, fell 0.82 percent, with falls in the stocks of major banks PKO BP and mBank leading the decline. The bourse’s banking stocks index, WIGBanki, lagged behind by 1.5 percent, with the share prices of Bank Millennium and BNP Paribas Polska decreasing by 6.3 percent and 1.6 percent, respectively. The issue addressed by the CJEU goes to the core of a long-simmering issue involving hundreds of thousands of mortgages denominated in foreign currencies, specifically the Swiss franc, which troubles Polish banks.

After Poland joined the European Union in 2004, many Poles, enticed by low interest rates, took up mortgages denominated in other currencies, notably the notorious Swiss franc. The Swiss franc rose against the Polish zloty in 2015 due to the 2008–2009 financial crisis, its ramifications, and the Swiss central bank’s decision to end currency regulation. Borrowers bound by facility agreements including indexation or denomination clauses began to fight banks over the allegedly unfair circumstances of foreign currency linking mechanisms, saying that they contained abusive terms and were thus ineffectual against consumers. Typically, in such circumstances, borrowers have asserted that the loan they were provided was in fact a Polish zloty loan, and that the link to a foreign currency should be broken by either nullifying the entire contract or removing the denomination or indexation mechanism. The major aim is to reduce the increase in debt caused by the surge in foreign exchange (FX) prices and restore the real number of Polish zloty disbursed.

As a result of the Swiss central bank’s decision to decouple the franc from the euro, the zloty declined dramatically virtually overnight, resulting in an increase in repayments. In terms of zloty, the franc is still worth more than twice as much as it was during the top of the CHF-denominated mortgage market. Not only were borrowers required to make dramatically greater payments, but the loan-to-value ratio of their properties also worsened, making it hard for them to sell their homes. In recent months, the Swiss National Bank increased its policy rate from 0.25 percent to 1 percent, therefore aggravating the borrowers’ predicament.

Long ago, the borrowers argued that the banks tempted them into the mortgages by underemphasizing the currency risk and deploying a number of so-called unfair conditions, such as in calculating their CHF-PLN spread. However, this is merely the most recent instance in a lengthy series of similar occurrences. Kamil and Justyna Dziubak v. Raiffeisen Bank International AG (C-260/18 – Dziubak) was resolved in 2019. At the time, the ECJ judgement did not specifically address the effects of Polish foreign currency borrowing. The ruling was meant to give direction to the courts about whether EU legislation puts any limits on the remedies Polish courts may employ when they conclude that specific conditions in loan agreements are harmful to clients who secured FX mortgage loans. Secondly, the ECJ ruling does not provide the criteria for deciding whether an indexation provision (or any other clause) is “abusive”. It says that each case must be reviewed on its own merits and that national courts are responsible for determining whether, in a particular situation, the loan terms may be deemed burdensome. If this is the case, the consequences of an abusive clause are typically controlled by the domestic law of each member state.

Similarly, the determination of whether the agreement may continue to bind the parties in the absence of abusive provisions lies with the local court and is guided by local law. Notably, the ECJ cited its past decisions in which it decided that contractual restrictions pertaining to FX risk may be seen as relevant to the main subject matter of the contract and, as a result, may be subject to a different degree of scrutiny in terms of their abusive nature.

Depending on the facts and arguments presented by the borrowers and creditors, as well as the prospect of a future ECJ ruling, several matters remain unanswered by Polish courts. Until there is strong and unambiguous case law supported by the Supreme Court of Poland, it will be hard to make general and definitive predictions about the path the courts may pursue – and, by extension, the amount of risk associated with bank or securitization fund portfolios. Nonetheless, the ECJ’s decision serves as a warning to all market participants, whether they are debtors or creditors, that the issue of house loan agreements using foreign currencies cannot be overlooked. Today’s forthcoming judgement goes much further and protects consumers in a manner that has never been established before.

Industrial production disappoints estimates

In addition to financial instability, the conflict in Ukraine continues to exert a negative impact on Poland’s industrial output. In January, export-oriented industries got some relief from lessened strain on global supply chains and lower natural gas prices.

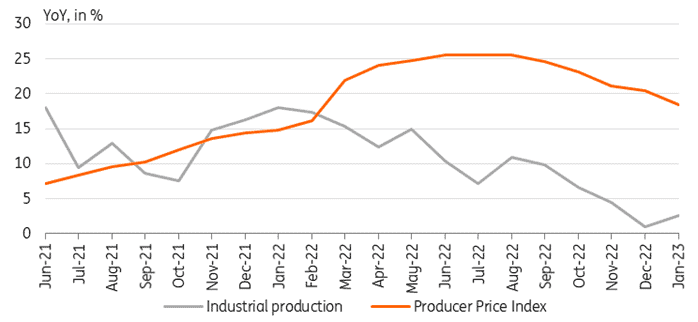

Industrial production grew by 2.6% year-over-year in January, which was well below our expectation and the consensus estimate of 4.0%, but better than the 1.0% YoY rate reported in December. Strengthening global supply networks continues to assist manufacturing, boosting production in a number of industries (especially automotive, electrical equipment, and machinery) (including automotive, electrical equipment, and machinery). The manufacturing of pharmaceuticals, food, textiles, and apparel has also increased substantially. The acceleration year-over-year was supported by a favorable schedule of working days. The output of chemicals, metals, computers, and wood decreased significantly, but this was mostly attributable to the high base year in these industries.

In agreement with forecasts, producer price growth fell from 20.5 percent YoY in December to 18.5 percent YoY in February. However, on a monthly basis, producer prices increased to 0.8% MoM from 0.6% in December, indicating the continuation of producer inflation. Three of the four major categories recorded by the Polish CSO (mine, electricity/gas/steam, and water supply/wastewater) showed month-over-month price increases, while manufacturing prices declined by 0.4% MoM compared to a 0.6% reduction a month before.

This study confirms predictions of a slowdown in economic activity in the first quarter and a gradual easing of pressure on producer prices due to a fall in wholesale energy costs, especially natural gas, as a result of the mild winter and a decline in gas use in Europe.

Sources

https://think.ing.com/articles/moment-of-truth-for-central-and-eastern-europe/

https://think.ing.com/snaps/polands-industrial-production-posts-meagre-growth-in-january/

https://archive.bpcc.org.pl/contact-magazine/issues/31/categories/145/articles/871

https://www.bloomberg.com/news/articles/2023-02-08/poland-holds-rates-as-easing-inflation-plays-into-hands-of-doves

https://www.bloomberg.com/news/articles/2023-02-15/polish-inflation-speeds-up-as-warsaw-s-forecast-clashes-with-eu

https://curia.europa.eu/juris/liste.jsf?num=C-520/21

https://curia.europa.eu/juris/documents.jsf?num=C-260/18

Also read:

The Polish Real Estate market between rising inflation and economic decline