Over the past few years, the warehouse market in Poland has been growing like wildfire, reaching record highs with historically low vacancy rates. Are we already dealing with a growing bubble or is this still a legitimate development?

There has been no shortage of stimuli to boost global demand for warehouse space. The trade war between the US and China in 2018-2019, which challenged the previous pattern of international trade, can be seen as the first turning point. Many companies, which until then had outsourced their production mainly to China, began to diversify their supply chains, gradually contributing to their greater regionalisation.

However, an event of incomparably greater magnitude was the COVID-19 pandemic in 2020. Due to sanitary restrictions, global supply chains were disrupted, contributing to higher prices of imported goods and the existence of shortages of raw materials and intermediate products. At the same time, the e-commerce segment began to gain importance, with its share of total global retail trade increasing from 13.7% in 2019 to 17.5% in 2021. Thus, according to a Harvard Business Review report, the pandemic has started the trend of shifting sourcing from the global to the regional level for good, shortening global supply chains to reduce their vulnerability to disruption and external shocks.

The last key event was the Russian invasion of Ukraine on 24 February 2022. The sanctions imposed by Western countries, consumer boycotts and damage to Ukraine’s infrastructure have contributed to energy commodity prices, material shortages and logistical disruptions that, according to a World Economic Forum report, could be felt up to 24 months after the war ends.

All of this turbulence in the global economy has contributed to a growing trend of regionalisation of supply, shortening of supply chains and, consequently, an increase in the need for local storage space. This is being felt in Europe in particular with the phenomenon of reshoring of production, i.e. relocating it back to the home economies, mainly from Asian countries. At present, the vacancy rate in most EU countries is below 5%, suggesting a continuation of historically high demand.

Polish warehouse market

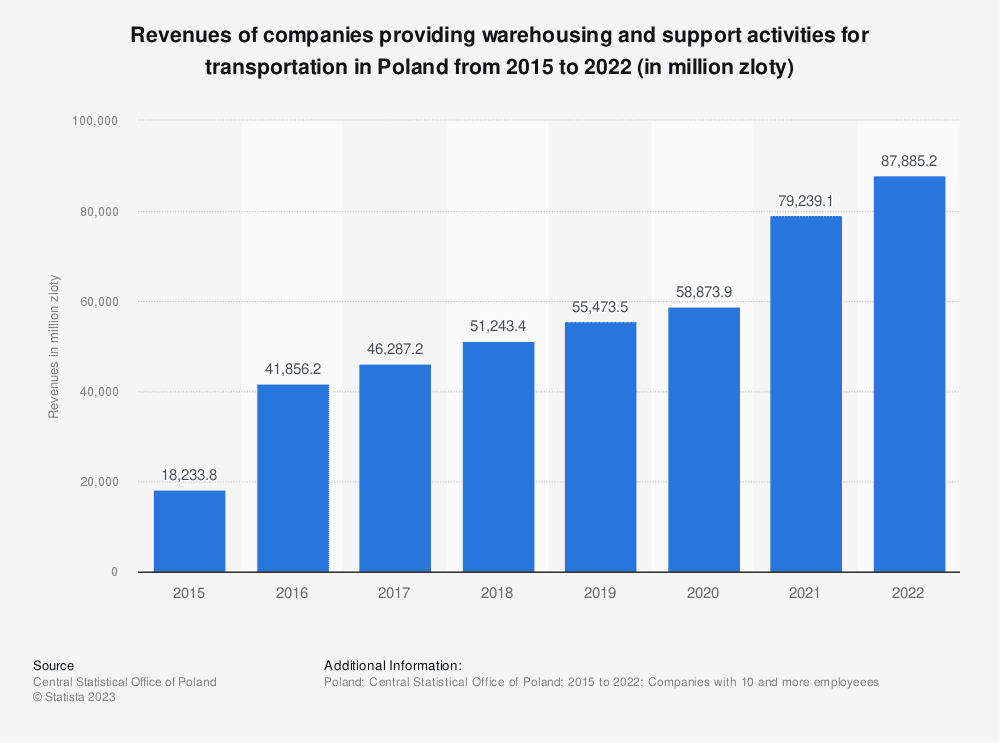

In Poland, as shown in Figure 1 below, revenues of companies providing warehousing and support activities for transportation grew considerably, with peaks in 2016 and 2021.

Figure 1

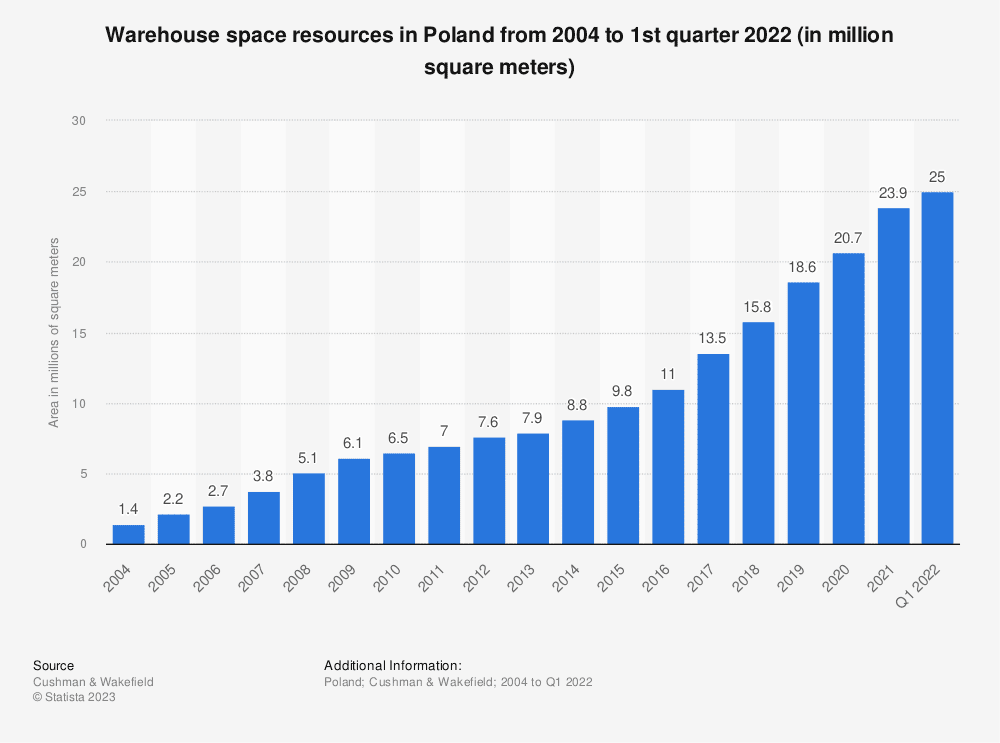

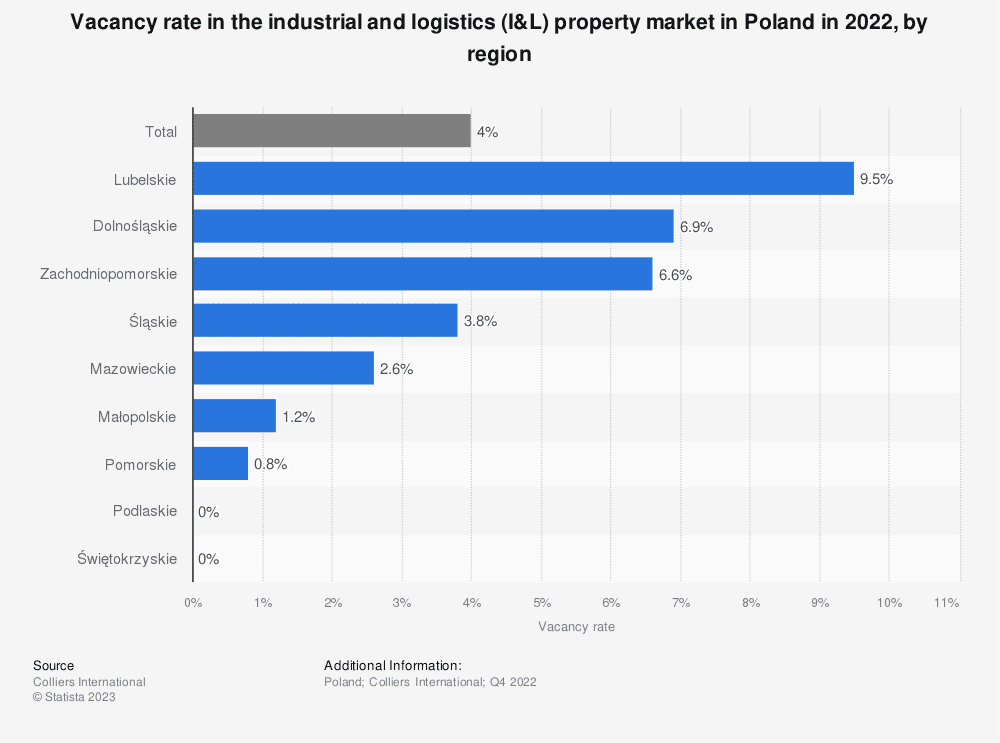

The Polish warehousing market stands out exceptionally against the background of European economies, growing by up to 20% annually in terms of space from 2004 onwards (see Figure 1 below for the historical growth progression), with a record low vacancy rate hovering around 4% in 2022. As shown in Figure 2 below, there are even entire regions with 0% vacancy rates in Q4 2022 for industrial and logistics properties. In Q2 2022, total warehouse stock in Poland reached 26.5 million m², making the country the fifth largest market in the EU and the second largest in terms of warehouse space under construction. While this means that the warehouse market in Poland is already developed more than proportionally to GDP (Poland is the sixth economy in the EU), there are a number of factors justifying this.

The Polish warehousing market stands out exceptionally against the background of European economies, growing by up to 20% annually in terms of space from 2004 onwards (see Figure 1 below for the historical growth progression), with a record low vacancy rate hovering around 4% in 2022. As shown in Figure 2 below, there are even entire regions with 0% vacancy rates in Q4 2022 for industrial and logistics properties. In Q2 2022, total warehouse stock in Poland reached 26.5 million m², making the country the fifth largest market in the EU and the second largest in terms of warehouse space under construction. While this means that the warehouse market in Poland is already developed more than proportionally to GDP (Poland is the sixth economy in the EU), there are a number of factors justifying this.

Figure 2

Figure 3

Firstly, warehouse space rental costs are, despite increases in the last 2 years, still among the lowest in Europe, oscillating around 4-5€/m2 , compared to 5-6€ in the Czech Republic, 6-7€ in Germany and even 8-10€ in the UK. At the same time, investments in warehouse space in Poland are characterised by higher rates of return of up to 6%, compared to 4% for most developed markets in the EU.

Firstly, warehouse space rental costs are, despite increases in the last 2 years, still among the lowest in Europe, oscillating around 4-5€/m2 , compared to 5-6€ in the Czech Republic, 6-7€ in Germany and even 8-10€ in the UK. At the same time, investments in warehouse space in Poland are characterised by higher rates of return of up to 6%, compared to 4% for most developed markets in the EU.

Secondly, the convenient location of Poland, which is the most important logistics hub for companies planning to expand into Central and Eastern European markets, is also an important factor. Particularly in view of the war in Ukraine, it is therefore possible that in the near future there will be a trend of relocating production from Ukraine, Russia and Belarus to Poland, given its membership of NATO and the EU and the growing East-West antagonism.

Against the backdrop of the changes initiated by the pandemic and the war in Ukraine, the demand for warehouse space in Europe will therefore continue to grow in the coming years. According to a CBRE Group report, up to 30 million m2 of additional warehouse space will still be needed in Europe by 2025, leaving plenty of room for further growth.

However, given the still high inflation in Poland (8.2% in September 2023 compared to the value for the euro zone of 5.3%), the dynamic growth in the value of the warehouse market to date and Poland’s accession to the group of developed economies, it cannot be ruled out that in the coming years rental rates in Poland will begin to approach those observed in Western Europe. Thus, the unprecedented growth in the value of the Polish warehouse market of the last two years should slowly stabilise, approaching the EU average of 10-11%.

As Renata Osiecka, Managing Partner of AXI IMMO Group, points out, the pace at which these changes will take place will be keyly influenced by the government’s decisions on policies related to inflation or finding new alternative supply chains for energy raw materials and building materials after Russia’s aggression in Ukraine. So let’s hope they will be thoughtful.