By Vladimir C. – Master in Political Sciences (Germany) – Blue Europe 2021 Contest – Review by Grzegorz Wiśniewski and Brian Fabregue

The European Union’s 27 member states now rely on Russia for a major share of their imported natural gas; this reliance will grow considerably bigger if European states continue to pursue their terrible existing energy policies. With plans to phase out nuclear power in several European countries, the EU’s goal of reducing coal consumption and thus greenhouse gas emissions, and the depletion of domestic gas sources, reliance on Russia has increased considerably even compared to only 10 years ago. Regardless of evolution of relations, EU countries must immediately collaborate to develop a coordinated diversification policy.

Nearly two decades ago, the European Union began introducing competition into the European natural gas market. As a result, a process emerged that fundamentally altered the gas market’s organization and coordination, as well as the function — or even the presence — of specific sorts of individuals. In the mid-2010s, the restructuring of the energy market process was still ongoing. Simultaneously, significant changes in the geopolitical, environmental, and technological factors of the European and worldwide energy and gas markets may be noticed. These changes have had a significant impact on the development of ‘reactive’ policies inside the European Union, both in Brussels and in the Member States. The progression of Europe’s natural gas policy toward a highly regulated form of a ‘well-functioning’ gas market continues to be a highly contentious and unstable experiment. Natural gas’s worth is continually fluctuating between economics, supply security, and sustainability. Additionally, the weight accorded to these values and their operationalization varies across Europe. As a result, establishing a ‘well-functioning’ EU gas market will always be a politically charged and never-ending story.

The notion that ‘the market’ requires additional development is a recurring message, and new rules, laws, and interventions are proposed on a regular basis. Initially, it was thought that these difficulties were caused by delays in the market restructuring process. The persistent exercise of market power by producers, wholesalers, and retailers harmed the EU gas market’s ability to function as an efficient coordination system. Indeed, competition between many suppliers has developed mostly in northwestern Europe, while other regions continue to be supplied by a single source, Russia, or a few. The solution is to increase competition through deeper restructuring, stricter oversight and control of market actors’ behavior, and more effective regulation of transportation and storage infrastructure.

Simultaneously, significant changes are taking place in the European and worldwide energy and gas markets, as well as the world in which these markets operate. To begin, the EU has been extended geopolitically by admitting additional Member States in central Europe that were previously Warsaw Pact members. Additionally, the erstwhile Soviet republics have achieved independence and are pursuing their own political and energy agendas, impacted or not by domestic conflicts. Second, in terms of energy and environmental policy, the growing acceptance of global warming as a result of the usage of fossil fuels has affected the EU countries’ preferences and priorities for energy supply. Thirdly, in terms of technological progress, the quick maturation of both LNG and unconventional gas (and oil) production has significantly affected both the local availability and transportability of gas resources. The latter, in particular, has had an economic influence on integrating the world’s three major continental gas markets: America, Eurasia, and southwest Asia.

As will be seen below, changes in these geopolitical, environmental, and technological drivers have had a significant impact on the development of ‘reactive’ policies in the European Union, both in Brussels and in Member States. Meanwhile, the overall energy and gas market policy objectives remain constrained by the EU’s unique vision of how to construct a ‘well-functioning’ market in a sector that exhibits at least some of the characteristics of a natural monopoly.

This begs the intriguing question of whether the existing European gas policy can continue on its current course of primarily establishing a ‘well-functioning’ gas market through more or less constant regulatory involvement. This, while in the second row, a slew of changes are occurring that affect the assessment of critical values such as natural gas’s role as the primary energy input in the European economy, supply security, sustainability, and the economics of gas supply. It is critical to highlight that these ideals are valued differently in different parts of Europe.

We will begin by discussing some of the essential aspects of the gas sector. Following that, we will briefly discuss how the European gas market has been restructured by later EU Commission directives and actions. Following that, we will address the fundamental changes in the European gas market and the global energy landscape briefly. We finish with a discussion of how these factors combine and the implications for gas in Europe.

The European Gas Industry

The natural gas industry is divided into three distinct sectors: Upstream, gas exploration and production occur. The midstream segment is responsible for transporting gas to local distribution grids, industrial users, and power plants. Generally, gas is transferred on a continental scale by high-pressure transmission pipelines. Overseas, the gas is transferred as LNG through tankers. Storage of gas is possible in salt caverns or depleted gas fields. Local distribution grids distribute gas to small home and corporate consumers downstream.

Developing, operating, and exploiting these production, transportation, distribution, and storage systems are difficult and risky endeavors. To begin, they necessitate significant capital expenditure; capital expenditure accounts for the lion’s share of total cost. Second, the assets involved are very specialized; once developed at a particular place, they cannot be withdrawn or repurposed if either the supply or demand of gas ceased. These charges have been’sunk’ literarily. Thirdly, all parties are entangled in some degree of interdependence with respect to one another. Pipelines, LNG facilities, and storage facilities are critical infrastructure for producers, traders, and end users. Thus, access to these facilities is a critical determinant of the supply system’s operation and the economic well-being of the parties involved.

Volume and price risk are critical in this regard. Gas producers and infrastructure operators will earn a profit only if their assets are operated at a fair rate of throughput and generate revenues sufficient to pay their costs over the long run. They require expect security. By investing in specialized gas-fired appliances and installations, users demonstrate their commitment to utilizing gas. They require supply assurance, certainly at a price that is acceptable in comparison to the cost of alternative energy sources.

Generally, as a result of these circumstances and the economy of scale associated with their technical and spatial characteristics, gas systems have been seen as natural monopolies incapable of competition. Historically, economic notions such as market flaws, market failure, and public goods have prompted governments to interfere and regulate the business in order to protect the public interest and the industry’s economic stability. In those countries that produced gas, the public interest in resource management served as an additional justification for state engagement.

In Europe, public coordination was almost often accomplished through direct official intervention. International gas transmission and wholesale commerce were administered by joint ventures between gas producers and national and local governments, while municipal gas firms managed local distribution networks and retail trade. Commercial transactions and market coordination were facilitated through long-term contracts, which included take-or-pay and destination clauses and linked the gas price to the price of oil products, which served as the primary substitute for gas, while gas producers received revenues on a net-back basis. The net-back principle states that producers (and governments) receive a residual amount after all costs are covered. Public finance and economic coordination were critical elements in this scenario. Gas production and sales were governed by complex exploration, production, and taxation systems. Frequently, gas price was employed to stimulate regional and sectoral economies.

Restructuring the European Union’s Gas Market

Since the late 1970s, such types of public involvement and market coordination have come under growing fire, originally primarily in the Anglo-Saxon world. ‘Rolling back the state’ in the manner of Margaret Thatcher and Ronald Reagan, as well as the introduction of competition, would enable more efficient provision of energy, water, public transportation, and other public services. The European Community established the Single European Market as a broad strategy for liberalizing the EU economy in 1985, followed by ‘The Internal Energy Market’ in 1988, which supported a similar reorganization of the EU’s energy sector. The fundamental justification was to remove restrictions to intracommunitarian commerce in products and services, but the neo-liberal perspective on competition and efficiency, as well as economic interests, also played a part.

On this foundation, a vision for a European gas market eventually emerged, with competition between gas producers and suppliers in the upstream segment and traders in the wholesale and retail segments. To accomplish this, it was anticipated that long-term contracts would give way to short-term transactions. The market price would be determined by scarcity situations, thereby balancing the supply and demand for gas. Liquid spot markets were predicted to develop in areas where diverse sources of supply met demand. A precondition for this was that competing traders would be granted access to critical transportation, distribution, and storage infrastructure necessary to reach their clients. To this purpose, Europe has embraced three fundamental regulatory ideas.

To begin, critical facilities would have to be ‘unbundled’ from production and trading activities, in the sense that their operators would have no commercial incentive to manipulate gas flows or to profit from the market intelligence generated by their systems’ operation. In the case of transmission and distribution pipelines, an increasing degree of legal and management unbundling has been required over time. The majority of networks were spun off from previous wholesalers and local gas utilities to be administered as either transmission or distribution system operators (TSO or DSO). In the case of other LNG, storage, and conversion facilities, other regimes were authorized with possible exemptions from third party access restrictions, to be provided on a case-by-case basis, depending on their position as a (local) monopoly in a ‘relevant’ market.

The second principle entailed the granting of ‘discriminatory access’ to these critical facilities for trading parties. This clearly included not only access to transportation infrastructure, but also to storage, LNG, and quality conversion facilities as needed. Initially, this was accomplished through relatively straightforward ‘first come–first served’ contracts, under which traders may reserve a given quantity of capacity for a specific time slot at a specified rate. Nonetheless, a more complicated technique developed through time, in numerous levels. Access to transmission pipelines has evolved into a so-called entry-exit model, in which ‘shippers’ of gas reserve their entry and exit rights for particular volumes of gas to be supplied into or removed from the transport system at certain places.

The core of this model is that it abstracts away from the real paths taken by gas molecules on their way to their destination. As a result, it gives shippers the greatest possible flexibility in terms of purchasing and selling to market partners regardless of their location. Tariffs for entry and exit at certain sites are uniform for all shippers. In general, when it comes to distribution networks, so-called postage stamp tariffs are used, in which a seller books his admission into a certain zone based on the location of his client at a pre-specified tariff. Other facilities’ access criteria are determined by their exemption status; either their owners or operators must grant access to any interested users under pre-specified conditions, or they are free to select how they use their capacity.

A critical component of providing access, in conjunction with the tariff system, is allocating available capacity to interested shippers. Beginning with simple first come–first serve regulations, a complicated series of processes was devised to maximize the utilization of the physically restricted capacity available to shippers, therefore decreasing so-called contractual congestion. On the other hand, the purpose became to allocate scarce capacity efficiently to those shippers who place the greatest value on it. As a result, a range of mechanisms for tendering and secondary trading capacity, as well as re-allocating underutilized capacity, have been devised. The overarching goal was to enable shippers to match the commodity transactions they organized in the gas market with the proper handling arrangements for transporting the gas to their clients or storage facilities.

A third principle was that the gas infrastructure inherited from the conventional gas sector still reflected the inherent monopoly status of the industry. The primary factors in this regard were ‘gold-plated’ excessive investment in assets, high operational costs, high tariffs that did not represent the actual, economically efficient costs of transportation, and difficult procedures discriminating between different types of consumers and regions. To reduce the cost of infrastructure, tariff and/or revenue regulation would have to compel TSOs and DSOs to improve their operational efficiency and system use. This eventually evolved into a slew of price cap, yardstick, and RPI-X regulations. To this purpose, each Member State was required to establish a National Regulatory Authority (NRA) for the energy sector, which would be responsible for approving and monitoring tariffs (or procedures) that would assure non-discriminatory access to unbundled networks.

Implementation of the European natural gas strategy

Following some first experiments in the early 1990s, this liberal proposal for a gas market was adopted in stages. The European Commission issued progressively detailed and strict standards for Member States to implement with three consecutive Gas Directives. The 2009 Directive, often known as the Third Package, was particularly significant in that it united the many national approaches. This was in response to the Commission’s Directorate-General for Competition’s ‘Sector Enquiry’, which determined that a lack of access to infrastructure and the concentration of power in a few corporations were impeding the establishment of a healthy gas market.

Another significant part of the Third Package was the expansion of EU-wide collaboration. Concerning NRAs, the Commission established the Agency for the Cooperation of National Energy Regulators (ACNER) in 2009. (ACER). Since March 2000, the regulators have been cooperating freely through the Council of European Energy Regulators (CEER), in conjunction with the Commission-established European Regulators Group for Electricity and Gas (ERGEG). ACER was established to resolve regulatory gaps in cross-border circumstances and to facilitate EU-wide regulatory coordination. Its mission is to harmonize national market and network operation standards and to encourage investment in trans-European infrastructure. Additionally, in 2009, the unbundled national TSOs joined the European Network of Transmission System Operators for Gas (ENTSOG) to promote cross-border gas commerce and enhance the European transmission network, including by developing a 10-year gas network development plan.

The expanded EU-wide cooperation resulted in additional efforts toward attaining ‘frictionless’ cross-border gas trading in the EU through the gas target model (GTM) program. The GTM is intended to establish cross-border connections between national or regional entry/exit areas, suggesting that the price of gas in the area will be determined by instantaneous supply and demand, as in a virtual spot market. The delivery of long-term contracted volumes of gas will then occur at the entry/exit area’s boundaries, establishing the market price, which will also be influenced by occasional inter-area volumes acquired on a short-term basis.

Concerns concerning the security of gas supply were raised during the first decade of the twenty-first century. In 2004, the European Commission enacted a Directive (2004/67/EC) with the objective of establishing a standard framework for Member States’ security-of-supply policies that is compatible with the needs of a single gas market. Between 2006 and 2009, disputes between Russia and Ukraine created supply concerns in central and south-eastern Europe, prompting the implementation of a new rule (994/2010). This rule aimed to integrate national actions and establish universal minimum requirements for readiness in order to increase inter-state solidarity in the event of a catastrophe.

As tensions between Russia, Ukraine, and the EU grew, a so-called stress test was conducted in 2014; security of gas supply; and, more recently (in 2016), a draft proposal for a more comprehensive security of supply legislation was issued. This draft targets industry, Member States organized geographically, who are responsible for ensuring supply to protected customers, and the European Commission, which is responsible for overall coordination and consistency. The document emphasizes the importance of regional cooperation in developing preventative action plans and emergency plans. Additionally, it proposes an infrastructure standard that ensures gas delivery even when the largest infrastructure is unavailable, while allowing for permanent bidirectional transmission capacity.

The Role of Gas in the Energy Union’s Policy

The Commission presented its Energy Union agenda in February 2015, announcing a radical restructuring of Europe’s energy system. It aims to provide EU consumers with secure, sustainable, competitive, and affordable energy in light of an ambitious EU climate policy. The following are the primary components of this policy: (1) energy security, solidarity, and trust; (2) a fully integrated European energy market; (3) energy efficiency as a tool for demand management; (4) economic decarbonisation; and (5) research, innovation, and competitiveness. The EU is stated to need to’move away from a fossil-fuel-based economy, one that is based on a centralized, supply-side approach to energy and is reliant on outdated technologies and business models.’

Observations and aims on the role of gas are primarily focused on energy security, solidarity, and trust, with a significant emphasis on the importance of diversifying energy sources, suppliers, and transportation routes. The critical elements are as follows: first, the development of a Southern Gas Corridor to enable central Asian countries to deliver gas to Europe; second, the establishment of liquid gas hubs with multiple suppliers in northern Europe, as well as central and eastern Europe and the Mediterranean region; third, the construction of additional transportation infrastructure, aided by community funding instruments and European financial institutions; and fourth, the preparation of an Integrated Energy Strategy. Finally, when it comes to domestic energy production in order to reduce reliance on imports, the plan refers ‘notably’ to renewables, which are necessary for decarbonisation, as well as conventional and—for those Member States that choose it—unconventional oil and gas, ‘provided that issues of public acceptance and environmental impact are adequately addressed.’

How well does the European Union gas market functions?

The modifications outlined above have significant implications for the prevalent view of what constitutes a ‘well-functioning’ EU gas market. To begin, we witness a continual push toward the formation of a competitive gas market through sector regulation, which addresses the increasingly debundled pipeline, storage, and LNG infrastructure, and through competition policy, which addresses the industry’s leading suppliers and traders.

The implication is that investments in new supply infrastructure are highly dependent on investor and TSO expectations regarding their suitability for future gas flows, and on regulatory decision-making. With regard to the massive requirements for transport, storage, and LNG infrastructure resulting from the Energy Union’s aims of internally securing gas supply to regions and connecting liquid market areas, it appears improbable that private parties will make the required investments.

Concerning producers’ and dealers’ interest in supplying gas to the EU market, both demand and price expectations are critical. On the demand side, we have explained that future expectations for gas use are highly uncertain due to the ambitious goal of transitioning away from fossil fuels, the relatively stable state of the European economy, and, at least for the time being, the disadvantage of gas in power generation in comparison to zero-marginal-cost renewables and low-cost coal.

On the supply side, we have argued that, apart from the conventional suppliers, such as Russia and Norway, there are few pipeline supply alternatives available, as a result of political instability in many potential producing countries and transit difficulties. Indigenous resources are rapidly depleting. This leaves LNG as the primary source of future supply, either through reliable long-term contracts or through spot cargoes at world market prices. However, the former arrangement requires certainty of demand in order to justify the necessary expenditures and readiness to pay the price. Both of these requirements are difficult to meet in the current environment. The latter arrangement entails a degree of danger. The price is low in the current oversupplied gas market. That, though, may change.

Probably the most significant insight gained from this longer-term view of the evolution of European natural gas policy is that a highly regulated version of a ‘well-functioning’ gas market remains a highly politicized and unstable experiment. As stated in the introduction and demonstrated in the preceding sections, the economic value placed on natural gas as a source of energy in the European economy is continually shifting between economics, supply security, and sustainability. Additionally, the weight accorded to these values and their operationalization will vary across Europe. As a result, establishing a ‘functional’ gas market will always be a highly politicized and never-ending story.

Historic European dependency on Russian natural gas

With the development of extraction and pipeline technologies in the 1960s and the continuous postwar reconstruction of Europe, East–West gas commerce became all but unavoidable. Since then, Russia has desired to supply gas and Europe has desired to purchase it. Energy shocks and gluts; major political crises ranging from Poland to the former Yugoslavia; the collapse of the Soviet Union and the rise of Russian President Vladimir Putin’s authoritarian state; outright warfare in Ukraine and elsewhere; massive deregulation experiments; and the rise of environmentalism have marked the last 50 years. Nonetheless, Europe’s relations with Russia in the natural-gas sector have stayed essentially consistent. This is because three things are sluggish to change: proven gas sources, collective energy consumption, and investment in physical infrastructure to connect the two.

In aggregate, this unified EU approach has bolstered Europe’s hand. Russia cannot exploit particular countries through embargoes or market fragmentation. And Gazprom — which retains a near-monopoly on Russian exports despite declining domestic market share — is incapable of establishing strong positions in Europe. This is a huge development – and a favorable one from a Western standpoint.

Yet it is difficult to understand how EU measures have fundamentally impacted Russia’s gas trade with Europe. Both exporting and importing nations have developed strategies for retaining overall market dominance. A book by Thane Gustafson, The Bridge (2020)appears to indicate that the fundamental effect of EU consolidation has been to protect a mutually beneficial economic status quo from upheaval.

Around 40% of the EU’s natural gas imports came from Russia in 2018. Gazprom, Russia’s state-owned gas monopoly, provided 200.8 billion cubic meters of gas to European countries in the same year, with 81 percent of the gas going to Western Europe (Gazprom, 2018), with this volume continually increasing. While both parties are interdependent, the partnership is far from successful. Apart from clear historical grudges, particularly between the bloc’s eastern member states and Russia, current geopolitical developments, most notably the 2014 Crimean crisis, have worsened tensions. The EU, the US, and a number of other countries imposed sanctions on Russia, primarily targeting the financial and energy sectors. They were, however, restricted to the oil sector, owing to the EU’s reliance on Russian gas. This particular nuance elucidates an intriguing interaction between the two.

Eastern member states perceive themselves to be particularly vulnerable as a result of pre-existing historical anxieties and a greater reliance on Russia. Prior to the 2015 opening of the Klaipeda LNG facility, the Baltic states imported all of their natural gas from Russia. With this in mind, the relationship between the EU and Russia resembles an unhappy marriage. Russia requires the European Union at the moment, and the European Union requires Russia. Europe satisfies its energy requirements. Russia’s hydrocarbon exports contribute significantly to the state’s revenue, accounting for more than 50% of the consolidated budget .

Dependence on Russian gas is viewed as a threat to the EU’s money, influence, and security. I argue that these concerns are exaggerated in this article. It would be counterproductive for Russia to upset its Western ally. I’ll elaborate on this shortly.

The European Union and its allies long-term goal should be to diversify its supply channels. However, in the short term, it will remain dependent on Russia for three reasons: geographical closeness, existing infrastructure, and Russia’s energy volumes.

Following the 2014 Crimean crisis, the European Union has grown increasingly concerned about Russia’s reliability as an energy partner. It brought back memories of the Russo-Ukrainian gas wars of the 2000’s and early 2010’s. Ukraine, like the majority of post-Soviet governments, is reliant on Russia for the majority of its energy needs. This gives the latter considerable political clout at the negotiating table. In 2014, Russia requested that Ukraine repay its energy bills, which, when it did not, resulted in Russia cutting off the country’s gas supplies . While the supply delays were limited to Ukraine, they caused difficulties in several other European countries.. This is the source of Europe’s anxiety. Disruptions in the supply of natural gas have the potential to significantly distort economic and household operations.

As a result, the EU enacted comprehensive legislation establishing an internal energy market for electricity and natural gas, as well as a regulation on gas supply security. Given the critical role that energy plays in modern businesses and homes, the EU has taken significant steps to avert supply chain disruptions. There are plans for an energy union that would “provide secure, sustainable, competitive, and affordable energy to EU consumers – homes and enterprises” (European Commission, n.d).

How Europe’s Gas Dependence on Putin Has Grown

Europe’s relations with Russia are approaching a low point not seen in decades. Yet now, President Vladimir Putin’s willingness – or unwillingness – to release the spigot on Russia’s abundant natural gas may influence how cold many Europeans experience this winter. This is despite the European Union’s decade-old pledge to lessen its reliance on Russian energy in order to avoid this type of vulnerability. It has been a source of contention within the economic bloc and has exacerbated tensions with the United States.

A supply shortage in October provided a stark reminder of Europe’s reliance on Russian gas flows. After longer-than-usual maintenance at Norwegian fields and Russia expanding its own supplies, gas storage tanks in the EU were at their lowest seasonal level in more than a decade. On Oct. 6, benchmark gas prices reached 162 euros ($188) per megawatt-hour, up from approximately 20 euros at the start of the year. Nord Stream 2, a new Russian pipeline under the Baltic Sea to Germany, was completed in September against this backdrop. Yet, Russia has, as the main clients in Europe confirmed, met all its intended supply requests.

Russia’s energy minister, Aleksandr Novak, has made a direct link between resolving the gas crisis – caused by demand outstripping supply as economies reopened following the collapse of the Soviet Union – and the opening of the Nord Stream 2 pipeline, stating that it would send a ‘positive signal’ that would help ‘cool’ the market.

Russia’s objective as to gas is actually quite clear. Russia wants Germany and the EU to give it the clearance it needs to begin using the pipeline in exchange for expanding gas supplies, according to sources close to Gazprom and the Kremlin. It may not be approved until May 2022 if regulators exhaust all available time. Putin actually intervened to relieve market pressure in late October, ordering state-owned gas giant Gazprom PJSC to begin refilling its European gas storage facilities. Crisis in Ukraine has slowed down the process.

Gazprom supplied about a third of all gas consumed in Europe in 2020 and is set to become even more critical in the short term as the continent’s local output declines. Russian gas is appealing since it is frequently inexpensive and nearly always available. The bloc’s largest economies are closing coal plants and some are even (foolishly) considering the abolition of nuclear energy. Natural gas accounted for around 22% of Europe’s energy mix in 2019, and Russia’s status as a significant supplier has been bolstered by the depletion of United Kingdom and Netherlands-controlled North Sea gas fields.

The US voiced strong opposition, imposing sanctions that slowed but did not halt construction. President Joe Biden and his predecessor, Donald Trump, both cautioned against Europe becoming overly reliant on Russian gas. Poland, Slovakia, and other countries that host existing pipelines were also opposed, claiming that the project would bolster Russia’s hold on the region by allowing it to bypass countries at will, including Ukraine. This is extremely doubtful, as since 2014, when Ukraine’s pro-Russian president was deposed and Russia invaded the Crimean Peninsula, and has been replaced my a pro-US former actor, Mr. Volodymyr Zelensky.

A lack of alternatives

Natural gas is a critical component of global energy use, and Europe is no exception. The EU consumes 17% of global energy and consumes the same amount of annual global natural gas production. Contrary to common belief, the great majority of electricity is generated by burning hydrocarbons to heat water and convert it to steam to power turbines. Hydroelectric, nuclear, and renewable energy sources combined generate far less electricity than natural gas, coal, and oil, except in specific countries, such as France, Slovakia and Finland. Additionally, natural gas is the favored hydrocarbon for generating electricity because it is the cleanest burning and costs less than coal.

Apart from commercial power generation, natural gas is used in a wide variety of industrial applications. It is the raw material for a wide variety of chemical goods, fertilizers, and pharmaceuticals due to its low cost of butane, ethane, and propane. Additionally, it serves as the primary component of a variety of polymers, textiles, and antifreeze.

While there are relatively few natural gas filling stations in Europe, public buses are increasingly using this fuel, which emits far less pollution than gasoline and diesel. Given natural gas’s numerous applications, its favorable price relative to renewables, and its emission-control benefits, most energy predictions indicate that natural gas will account for roughly one-third of the total European energy mix by 2030, nearly eclipsing oil in relative importance.

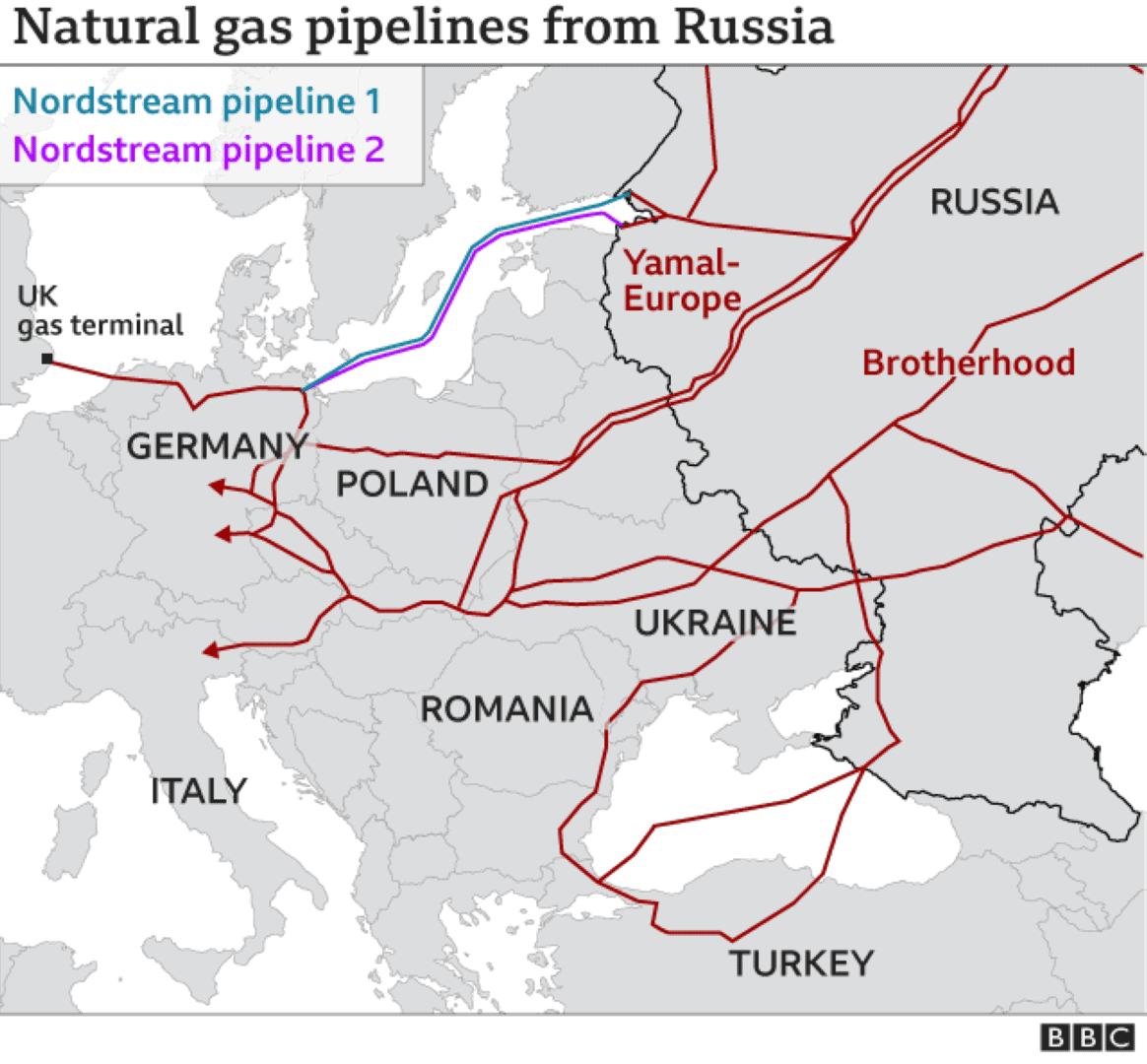

External supplies, primarily from Russia, Norway, and Algeria, account for approximately 80% of the gas consumed by the EU. Several of the world’s largest economies are particularly vulnerable, with Germany importing 90 percent of its needs, with a considerable share of oil also coming from those counties. Belgium, Spain, and Portugal all face a shortage of storage capacity. The continent is crisscrossed by pipelines, such as Yamal, which runs from Russia through Belarus and Poland to Germany, and TAG, which transports Russian gas to Austria and Italy. Numerous them straddle multiple borders, generating numerous potential choke points.

Russia possesses the world’s greatest natural gas reserves, thanks to its massive Siberian resources. It began exporting to Poland in the 1940s and developed pipelines in the 1960s to distribute fuel to satellite states of what was then the Soviet Union. Even during the height of the Cold War, supplies were regular. However, since the collapse of the Soviet Union, Russia and Ukraine have been at odds over pipelines passing through Ukrainian territory, pushing Russian officials to seek alternate routes (and creating both NordStream 2 and the successors pipelines to SouthStream).

In 2006 and 2009, disagreements over gas pricing and siphoning resulted in Russian supply being cut off. In the thick of winter, the second shutdown lasted nearly two weeks. Slovakia and several Balkan countries were forced to ration gas, close enterprises, and reduce electricity supplies. Since then, the most susceptible countries have rushed to establish pipelines, connect grids, and construct terminals for the import of liquefied natural gas, a supercooled version of the fuel that can be transported from remote resources such as those in Qatar. Still, no major long term partnership have been established, at least according to Russian energy providers. It is also known that volumes increased, in absolute terms, in 2021.

One other major reason why Europe is so dependent on Russian Gas is the continuous sabotage by the EU (mainly Germans) politicians of all African partnerships as to gas and oil. ENI, the Italian historical energy provider, has been allowed only recently to make partnership with Egyptians and Lybian companies, after years and years of discussions.

What about the future?

As natural gas prices continue to rise, Europe has finally recognized its reliance on Russian natural gas. This situation will deteriorate further with the certification of Nord Stream 2, but there is still time to avert disaster.

Since the pipeline’s initial construction in July 2018, Nord Stream 2 has been dogged by controversy. The project will link Russia and Germany via the Baltic Sea and would supply Central Europe with 55 billion cubic meters of gas per year. The pipeline’s supporters argue that it will expand Germany’s economic opportunities and alleviate Central Europe’s sensitivity to Russian-Ukrainian and Russo-Belarusian relations.

In the aforementioned book by Thane Gustafson, the authors deals with this well known problematic by talking long-term threats, which he then dismisses. For two decades, Russia’s battle with Ukraine — first over oil pricing, then over politics — has prompted it to propose new pipelines that skirt its neighbor geographically. Many fear that additional lines, such as Nord Stream 2, may completely bypass Ukraine. Gustafson is certain, though, that if this occurs, Kiev, which is already phasing out Russian natural gas, will find alternative suppliers.

Another threat is posed by new technology alternatives for delivering fuel in the form of liquid natural gas, a more fungible form that would allow for US imports into Europe. This could provide an alternative to stable pipeline politics, albeit the shift would be gradual due to the technology’s higher cost. Additionally, environmental protection and climate change concerns will continue to grow, decreasing long-term European demand. Nonetheless, natural gas will remain abundant, relatively inexpensive, and environmentally preferable than oil or coal power in the interim.

Bibliography

ECFR. ‘Beyond Dependence – How to Deal with Russian Gas – European Council on Foreign Relations’, 29 October 2008. https://ecfr.eu/event/beyond_dependence_how_to_deal_with_russian_gas/.

Correljé, Aad. ‘The European Natural Gas Market’. Current Sustainable/Renewable Energy Reports 3, no. 1 (1 September 2016): 28–34. https://doi.org/10.1007/s40518-016-0048-y.

euronews. ‘Europe Must Reduce Its Dependence on Russian Gas | View’, 1 November 2021. https://www.euronews.com/2021/11/01/europe-must-reduce-its-dependence-on-russian-gas-view.

‘European Energy Prices Soar as a Deep Freeze Arrives’. Bloomberg.Com, 19 December 2021. https://www.bloomberg.com/news/articles/2021-12-19/europe-braces-for-energy-crunch-this-week-as-deep-freeze-sets-in.

Moravcsik, Andrew. ‘Power of Connection: Why the Russia–Europe Gas Trade Is Strangely Untouched by Politics’. Nature 576, no. 7785 (2 December 2019): 30–31. https://doi.org/10.1038/d41586-019-03694-y.

Oxford Institute for Energy Studies. ‘Reducing European Dependence on Russian Gas – Distinguishing Natural Gas Security from Geopolitics’. Accessed 22 December 2021. https://www.oxfordenergy.org/publications/reducing-european-dependence-on-russian-gas-distinguishing-natural-gas-security-from-geopolitics/.

Thane Gustafson. “The Bridge: Natural Gas in a Redivided Europe” Cambridge, Mass.: Harvard University Press, 2020. iv, 506 p

E-International Relations. ‘The Energy Relationship Between Russia and the European Union’, 24 February 2020. https://www.e-ir.info/2020/02/24/the-energy-relationship-between-russia-and-the-european-union/.