Despite challenging experiences with the Euro’s governance, particularly during the financial crisis, the rules for joining the monetary union have remained essentially unchanged since their inception, and Croatia has followed the path into the Eurozone as set out in the Maastricht Treaty.

Croatia is the 20th country to decide to join the Euro club, replacing its own currency with the European single currency. Croatia’s choice follows that of the other new entrants: Lithuania (2015), Latvia (2014), Estonia (2011), Slovakia (2009), Malta and Cyprus (2008), and Slovenia (2007). There are now almost 340 million European citizens who live with the single currency.

The European Central Bank and the European Commission issue Convergence Reports at least every two years to assess the degree to which EU nations wanting to join the Euro comply with the aforementioned criteria and other aspects pertinent to economic integration and convergence.

From 2014 through 2020, Croatia’s convergence evaluations revealed that the nation satisfied the inflation and interest rate conditions, but not the public finances, ERM membership, or law compatibility criteria. In June 2022 the final obstacles to Euro membership were removed: the Commission’s Convergence Report found that Croatia met the requirements for adopting the Euro, with the exception of a higher debt level.[1]

After the European Council backed Croatia’s entrance to the monetary union at their late-June meeting, Eurozone Finance Ministers provided their official approval on July 12, 2022. The exchange rate for Kuna to Euro was established at 7.53450 to 1, and the date of official adoption was set to January 1, 2023.

Political background for the Euro adoption

The lengthy history of mistrust in the home currency dates back to the 1980s, a period of significant inflation in Yugoslavia during which companies and families utilized the German Deutschmark as a payment method and informal unit of account. Since its inception in 1994, Croatia’s currency, the Kuna, has utilized the D-Mark and the Euro as a point of comparison. For example, costs for real estate, automobiles, and lodging are frequently quoted in Euros. Moreover, the majority of individual and corporate deposits are already held in Euros, as are over two-thirds of debt.

The de facto “Euroization” of large portions of the Croatian economy has played a crucial role in countering the competitive devaluation argument against Euro membership – namely, that the ability to decrease the value of the domestic currency may be a useful tool to increase short-term competitiveness.

In tandem with the emergence of a Croatian service economy centred on tourism (which accounts for one-fifth of the country’s GDP), an economic climate was established in which the Croatian state held total control over its currency. This paradigm is becoming increasingly referred as outdated.[2]

In recent years, joining the Euro has become official government policy. Throughout this time period, Croatia’s politicians and central bankers have framed joining the Eurozone as a crucial step toward integrating the nation into the EU’s core and ensuring future economic development.[3]

According to a Eurobarometer survey conducted in 2022,[4] a consistent majority of 55% of the Croatian people supports the introduction of the Euro. Particularly, the tourist industry has high hopes for the unified currency, which would minimize conversion fees for visitors to Croatia.

However, the same survey reveals that 49 percent of Croats worry the Euro would have negative effects on their nation, while just 45 percent feel it will have beneficial effects overall. This statistic is even the more remarkable given that the evaluation has deteriorated drastically over the past year.

In 2021, just 40% of Croatians worried negative effects of Euro membership, while 56% anticipated beneficial effects. While Croatia’s political leadership remains hopeful about the country’s chances of adopting the Euro, barely one-third of the population believes the nation is well-prepared to enter the Eurozone. And 81 percent are concerned that the adoption of the Euro would increase costs.

This rising ambivalence about Euro membership certainly reflects the health of the local economy in part. In the initial period of the pandemic, when tourism nearly ground to a halt, Croatia experienced a tremendous economic hit. Additionally, as a result of the ongoing Russian conflict against Ukraine and rising prices, the nation is presently suffering uncertainty.

Economical reasons to join the Euro

In order to understand the reasons that made Zagabria interested in this endeavour, let us look at what was the expected scenario for the Croatian economy, highlighting what were the anticipated advantages and disadvantages of the Euro membership for Croatia: a country of almost 4 million inhabitants and with a GDP largely dependent on tourism, with a geographical configuration of a bridge between east and west.

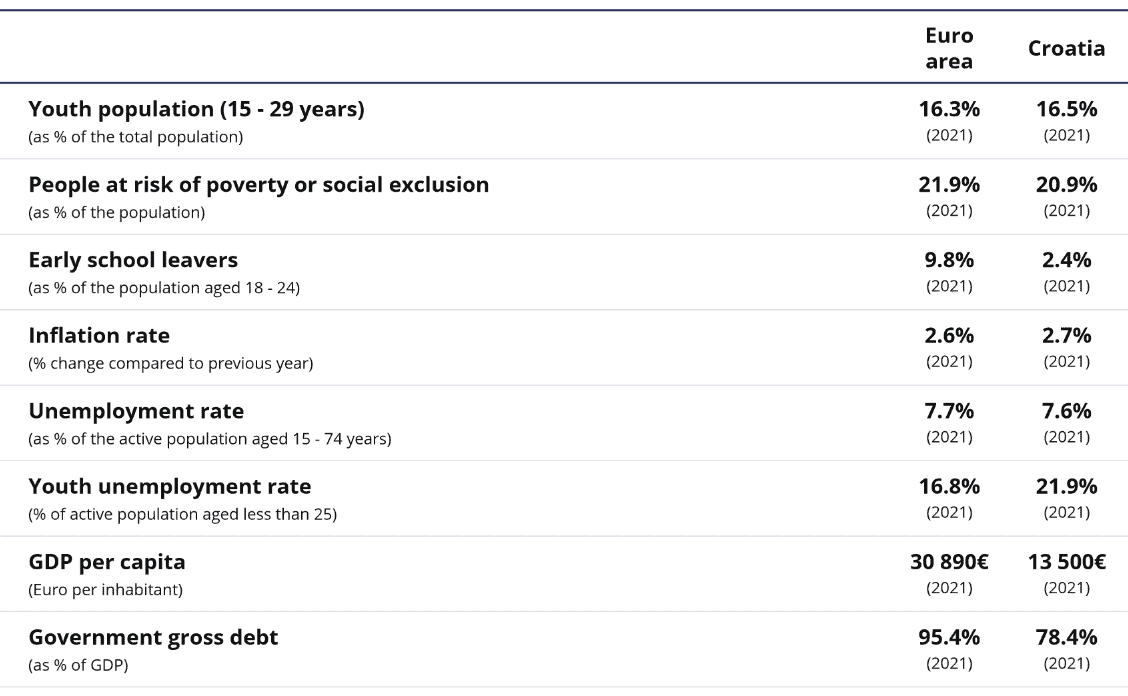

As can be seen in the table below, Croatia is well placed for participation in the single currency and for a solid anchorage to western societies. In the first place, a “low” public debt stands out, with the debt-to-GDP ratio at 78% and well below the Eurozone average (95%). Social statistics are well represented by the low level of school dropouts, which is accompanied by indicators on unemployment, poverty, and youth population that are within the Eurozone average.

A per capita GDP that is still considerably low, it confirms that the strengthening of ties with the single currency is seen with the hope of growth, which will certainly be supported by the strong trade ties that Croatia has with Europe, where two-thirds of exports are directed, and three-quarters of imports come from.

Source: Eurostat, 2023

The Croatian government’s choice towards strengthening ties with the European currency arose from a positive analysis of cost and benefits, representing a political challenge that deserves the support of the other partner countries. The Croatian economy has to face both advantages and disadvantages.

Main expected “costs” from the Euro adoption

The most important cost is surely the loss of monetary autonomy on the part of the national bank, which no longer chooses the interest rate and quantity of money ideal for the needs of the local economy. The cost stems from the assumption that there are high structural differences in countries’ public finances and that the ECB’s interest rate, while valid for the ‘average’ European country, is not ideal for individual national cases. Anyhow, it is important to say that compliance with the admission criteria has brought the public finances of the countries entering the single currency considerably closer together, and that membership of the European Union itself has fostered a considerable convergence of the economic cycles of the partner countries.

In the 1980s and 1990s national economic cycles were profoundly different, with countries needing restrictive monetary policies alongside countries pursuing expansive monetary policies, today we see instead a remarkable convergence, which is compatible with the use of a single currency and a single monetary policy. Economic integration and globalisation have slowly shaped partner countries, encouraging their convergence towards more similar economic and social models.

Another important “cost” concerns the possibility of devaluing the currency to gain price competitiveness advantages in international markets. However, it is important to note that the cycle created by devaluation, which temporarily improves exports only to be reflected immediately afterwards by higher import prices, might generate higher production costs and thus wipe out the previous export advantages.

Nevertheless, there are examples in which devaluation actually proved to generate substantial long-term benefits, one of which is the lira’s devaluation: with the currency crisis of 1992, exports gained considerable price competitiveness that was not subsequently reduced due to the agreement on labour costs of July 1993. When the government defined future wage increases with reference to the inflation expected and not with reference to the inflation suffered by workers (which was higher), the temporary loss of real purchasing power of wage earners kept the competitiveness of Italian companies at the international level high.

Expected benefits from the Euro adoption

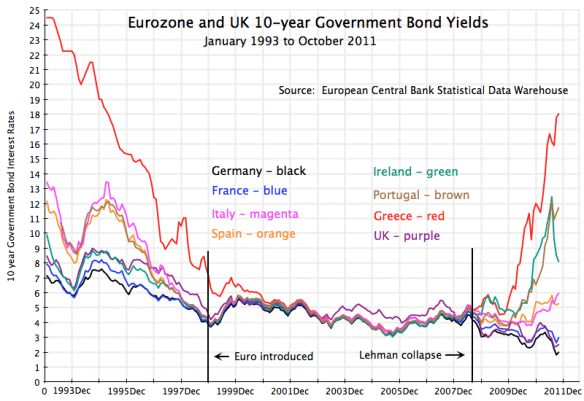

Let us now take a look at what were the expected benefits for the Croatian economy, which are very similar to those enjoyed by the first countries of the Monetary Union in January 1999: the most important and most positive impact is certainly on the interest rates of public debt. The interest rate that a saver wants to obtain from a sovereign debt security, quoted on international markets, depends mainly on three important factors.

The first is the ‘base’ interest rate on the international market, which derives from the macroeconomic and monetary conjuncture: an exogenous variable that shows periods with (relatively) low rates alternating with periods with (relatively) high rates.

The second factor is the debtor risk premium, which is added to the base rate to compensate for the probability that over the term of the bond the country will default and the creditor will not be repaid. This has already happened several times in the history of international finance, as savers who had invested in Argentinian bonds know. This is a variable that reflects the future sustainability of the current public debt and is indicated by rating companies. For example, debtor risk has very little effect on the rate of German sovereign debt, while it significantly raises rates on Greek and Italian bonds.

The third component relates to currency risk, i.e., the likelihood that over the life of the bond the country will devalue its currency. This is what happened to German investors who bought BOTs in the 1980s, when the lira devalued periodically in an attempt to compensate for the loss of competitiveness caused by inflation: the German saver at the bond’s maturity obtained a lower amount of marks than initially invested.

As of 1 January 2022, this negative component no longer existed for the Croatian Kuna, which is why the rate on Croatian debt is automatically reduced by joining the Euro club. In fact, the currency risk has no longer existed since July 2022, when Croatia passed the examination for admission to the single currency and the exchange rate was irrevocably fixed at 7.5345 Kuna per Euro.

In addition to the elimination of currency risk, it is worth pointing out that borrowing risk is also reduced by choosing the single currency, due to the country’s better reputation in the financial markets. The combination of the two advantages leads to a strong reduction in interest rates, as shown in the chart below on the sovereign rates of from 1993 to 2011.

Joining the Euro club was therefore expected to enable the Croatian government to shift economic resources from paying interest on public debt to investing in public goods for the welfare of its citizens. This is one of the biggest driver for the political decision to adopt the common currency.

From benefits to structural improvements

The above-mentioned expected benefits are the same advantages that the Euro-historical countries had on 1 January 1999, especially those that were particularly weak in terms of public finance, such as Italy, which enjoyed low spreads from 1999 until the US subprime financial crisis of 2008.

Unfortunately, for instance, Italy failed to turn these temporary advantages into structural improvements of its financial position and economic growth. There is a “small window” to transform savings from the lower debt burden into public goods that could increase factor productivity, such as investments in education, research, and infrastructure. Notably, this is not the case if a sterile increase of current public spending and aggregate demand occur without triggering investments and the Keynesian multiplier.

Hence, at this stage it is crucial for Croatia to increase public structural investments and for the European Union and the Euro community to help Zagabria overcome this challenge by exploiting the presented opportunities.

In Part 2 we will briefly analyse the initial consequences of the Euro changeover in Croatia at the economical and geopolitical levels. You can find it here.

References

- https://economy-finance.ec.europa.eu/publications/convergence-report-2022_en ↑

- https://jacobin.com/2022/07/croatia-euro-currency-eurozone-emu-ecb ↑

- https://www.bloomberg.com/news/articles/2022-01-24/why-croatia-sees-joining-the-euro-as-path-to-security-quicktake ↑

- https://europa.eu/eurobarometer/surveys/detail/2662 ↑