According to data from the National Social Security Fund of Lithuania, nominal labour income rose by 12.7% year-on-year, but could not keep up with the 20% inflation rate in January-March. The increase in average incomes was due to increases in the minimum wage and raises for civil servants. The income gap between the top 20% and the bottom quintile was little changed from the previous year, with the former earning on average 6.4 times more than the latter. The highest average incomes were recorded in Neringa and Vilnius, and the lowest in Kelmė district and Kalvarija. The average income in the capital was 47% higher than in the rest of the country.

64% of Lithuanians consider inflation to be one of the two most pressing problems facing their country, higher than the EU average of 53%, according to the latest Eurobarometer survey. However, this percentage has fallen by 5 points since last winter, while the average for the bloc has risen by 12 points. The next most important issues for Lithuanians were the economic situation (23%), energy supply (19%), international affairs (17%), taxation (14%) and health care (11%). These figures compare with the EU averages of 19%, 19%, 10%, 5% and 14% respectively.

Some 18% of Lithuanian employees expect their pay to increase by 10-20% next year, while 6% expect it to rise by 20-30%. However, more than a third of respondents (36%) do not expect any salary increase and almost 30% expect only a minimal increase of up to 10%. The survey also revealed that only 1% of respondents expect their salaries to increase by 30-50% over the next year, with the same proportion expecting an increase of over 50%. Those expecting substantial pay rises tend to be under 30, low earners with household incomes of up to 1,000 euro per month or employed in the public sector. Lithuania reported inflation rates above 20% in November and inflation is expected to continue next year.

The Lithuanian economy grew by 6% in 2021 after a post-COVID rebound, but slowed to 4.8% in annual terms in the first quarter of 2022, before declining further to around 2.8% in the following nine months. In the fourth quarter of 2022, the country’s GDP fell by 0.4% year-on-year, well below the 1.9% growth recorded in the euro area, according to Eurostat. The slowdown is due to energy problems, falling external demand as a result of the economic slowdown, galloping inflation, falling purchasing power and tighter financing conditions in some EU member states. Although economic forecasts have been volatile and characterised by constant revisions due to the unstable and deteriorating environment, the Bank of Lithuania and the Ministry of Finance have revised upwards their growth estimates for 2022 and 2023, citing the accelerated use of European funds with the new Multiannual Financial Framework and several disbursements from the National Recovery and Resilience Plan. Growth in 2023 is expected to be driven by domestic demand, especially public investment.

However, there are still concerns among economists as household consumption growth forecasts have been lowered to 1.4% in 2022 and 0.7% in 2023. Although households have built up good reserves, with bank deposits up by 12% compared to 2020, their financial wealth could be eroded by the geopolitical situation and rising energy and food prices. At the end of 2022, the household saving rate is at a record high, but it has already started to fall. The development of the household saving rate in 2023 will depend on deposit interest rates, price dynamics, wage developments and labour market conditions. According to the central bank, the household saving rate will be 4.2% in 2022 and is expected to rise to 6.2% in 2023. Meanwhile, household deposits with financial institutions will decline by 3% between December 2022 and January 2023. Nevertheless, confidence indicators have improved since November, boosting both business and household confidence, partly due to measures to increase public investment.

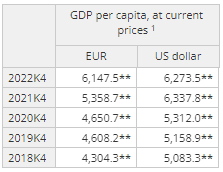

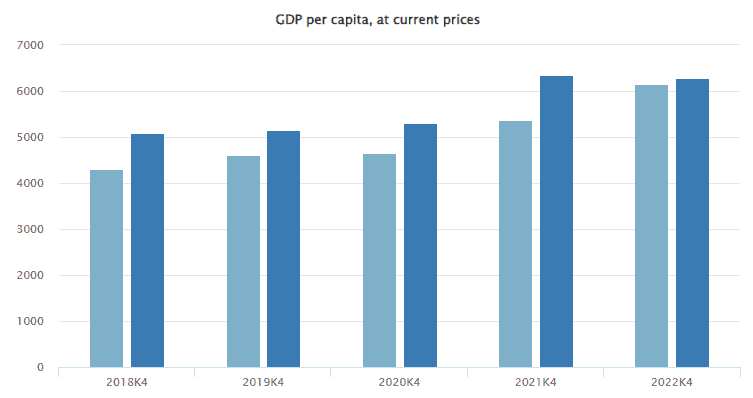

The GDP/hb has been rising steadily since the integration into the European Union. It reaches 6147€/hb at the end of 2022, or 6273$/hb (left and right columns respectively, discounted €/$ rate).

At the same time, inflation on energy, food and housing has risen, notably because of crisis management and the war in Ukraine.

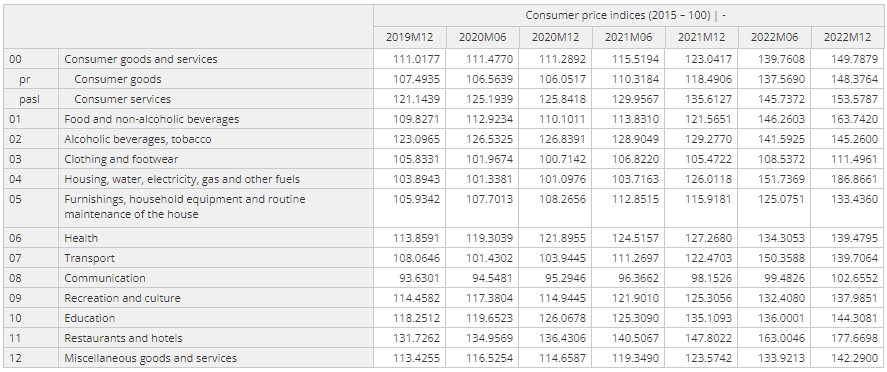

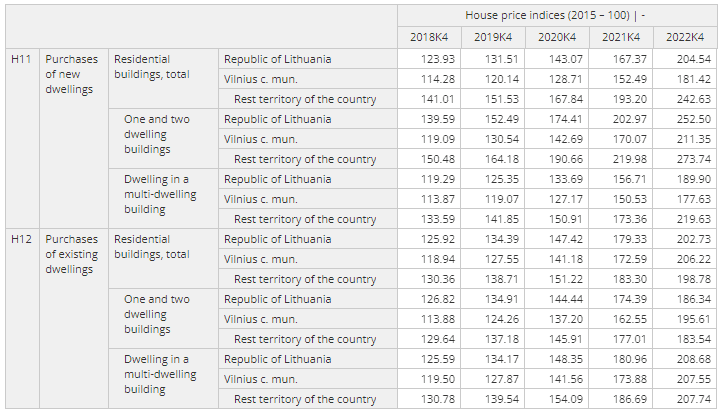

An overview of these increases in figures: all data are taken from the official website of the Lithuanian government statistics.

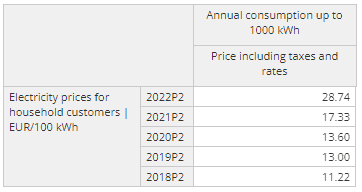

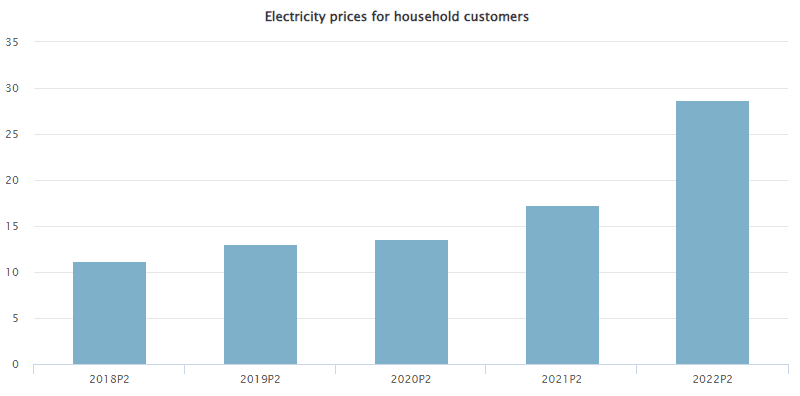

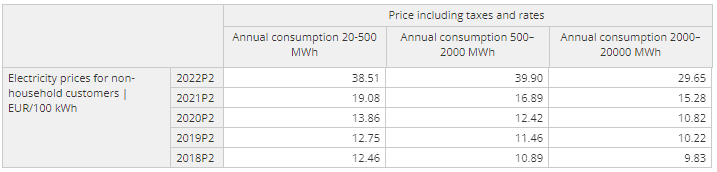

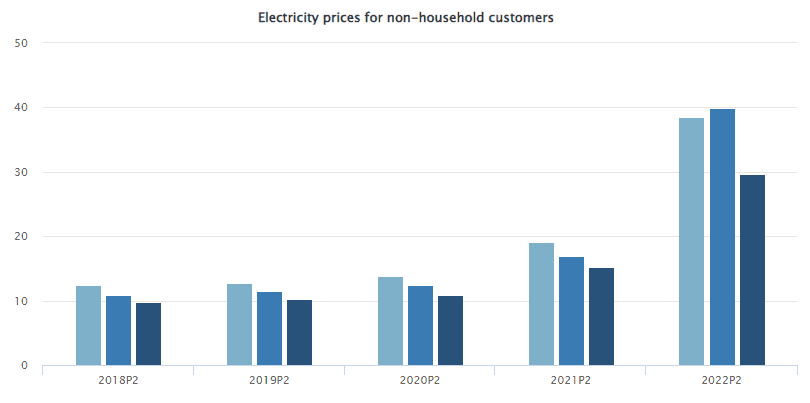

In 2022, electricity prices for households consumers have increased 2.5 times since the end of 2018, and have doubled for professionals. Large consumers retain a greater overall price advantage than in previous years (columns from left to right respectively prices in € per 100 KWh for small/medium/large professional electricity consumers).

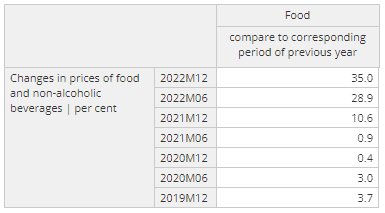

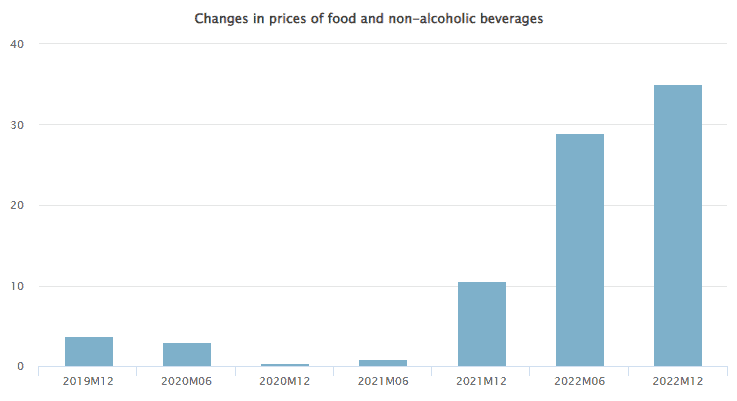

The charts above show the evolution of price inflation over 12 months in June and December of each year. Thus, in December 2020, inflation was almost nil, rising to 35% over one year by the end of 2022.

In base index points: evolution on the principle of a base 100 in 2015. Thus, since 2015 for example, housing/water/electricity/gas and other (category 04) has increased by 86% in December 2022.

In base index points: evolution on the principle of a base 100 in 2015. Thus, since 2015, for example, new housing has doubled in price in Lithuania (100 to 204 basis points) by December 2022.

Conclusion

Although rising costs of rent and basic commodities are causing some young people – including students – to move back in with their parents, the central bank’s forecasts point to a slowdown in inflation in the coming months/years. Key interest rates have been raised to 3.5% after several successive 75 basis point increases. It is also important to note that the Lithuanian government has not taken on massive debt, unlike for example the French government, which should facilitate a recovery of the economy without a sudden increase in taxation.