After the Netherlands, Romania is the second largest producer of natural gas in the European Union. It presently generates 11 billion cubic meters of natural gas per year, which is sufficient to meet its needs during the summer but can be insufficient during the winter. It is ranked 49th in the world for gas reserves with almost ten times its yearly consumption in reserves.[1] According to data from system operator Transgaz, Romania moved to net gas exports for the first time in almost a year and a half at the end of November, as sluggish demand allowed the country to balance on domestic production and storage alone.[2]

The crisis in Ukraine, on the other hand, has provided the push to end years of deadlock and increase drilling in the Black Sea in order to access potentially significant natural gas supplies that Romania may export. Such an investment would be of great significance and would be welcomed by Romania’s neighbours. This includes the countries of Moldova, Ukraine, Hungary, and the Balkans, who are continually seeking new energy sources.[3]

Natural Gas

Romania has the largest natural gas market in Central Europe and was the first country to use natural gas for industrial uses. As the second-largest gas producer in the European Union with substantial reserves, including those newly discovered in the Black Sea, Romania is the country in the region that imports the least natural gas. It is advantageously located between developed markets in Central Europe and supply sources in Southeast Europe. In addition, Romania has connections with Bulgaria, Ukraine, Hungary, and Moldova, as well as storage.

Lately, Romania has begun delivering natural gas to Moldova, which is straining to satisfy energy demand in the midst of the Russian invasion of Ukraine. On December 3, gas began to arrive via a pipeline connecting the eastern Romanian city of Iasi to the Moldovan border town of Ungheni.[4]

Although the potential for LNG development in Romania’s Black Sea territory could be a significant game-changer for the EU, the Black Sea currently lacks an LNG terminal. Due to Turkey’s stance on LNG tankers passing through Istanbul and the Bosphorus Strait, this sector is highly competitive and capital intensive to enter. The Constanta LNG project could be operational by 2026, but private investment is still required.

Romania has the potential to become the greatest net exporter of natural gas in the European Union, partly as a result of its untapped Black Sea gas deposits. Its onshore gas reserves are believed to be 100 billion cubic meters, while those in the Black Sea’s deep waters are estimated to be between 42 and 84 billion cubic meters.[5] This quantity is adequate for both domestic consumption and export.

This subsector will receive significant attention for the development, operation, and maintenance of onshore and Black Sea offshore fields: the discovery of new gas reserves in the Black Sea basin presents opportunities for companies with expertise in drilling, transmission, refining, and retrofitting existing facilities.

Nuclear Power

Nuclear energy will be an integral part of Romania’s energy mix for many years to come.

Construction, commissioning, and safe operation of Cernavoda NPP Units 1 and 2 and other nuclear facilities such as the heavy water plant, the nuclear fuel plant, research institutes, engineering and advanced physics centers, and education have provided Romania with a long history and extensive nuclear expertise. There is presently one nuclear power station in Romania, Cernavoda, with two active reactors, and two more are under construction.[6]

The two additional nuclear reactors at the Cernavoda power plant are paving the way for a new type of nuclear technology – small modular reactors, which are a new class of nuclear fission reactors that are smaller than conventional ones and can be built, shipped, commissioned, and operated at a different location. Relevant is the fact that in June 2020, the Romanian government canceled a Memorandum of Understanding inked with a Chinese corporation in favor of a partnership with the United States.[7]

Green Energy

Renewable energy is an ever-increasingly popular and desirable topic in Romania; moreover, the Romanian government is passionately dedicated to the green transition as a means of achieving energy independence.

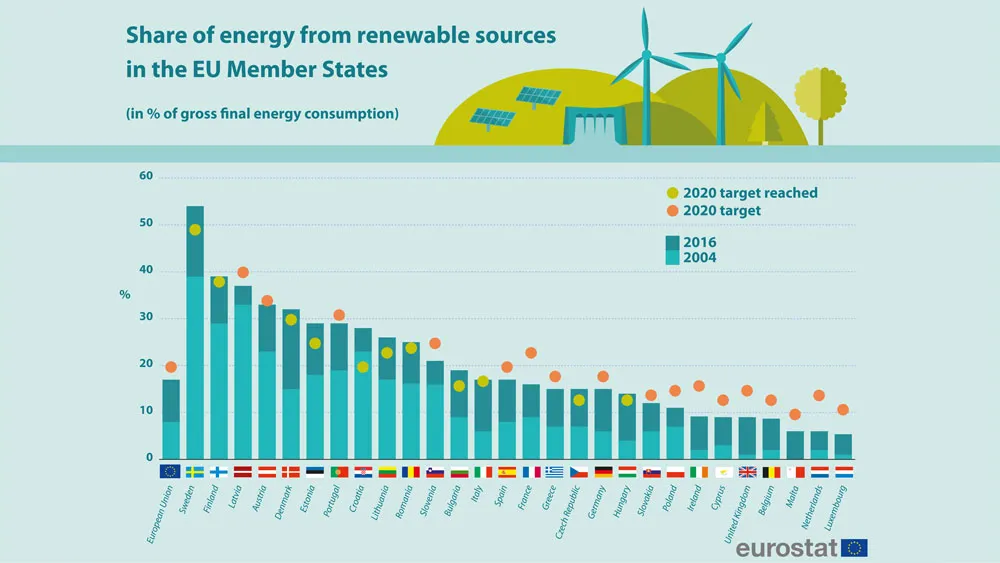

In order to attain its renewables goal of 30,7 percent by 2030,[8] Romania wants to install approximately 7 GW of new capacity, of which approximately 3.7 GW will be solar projects. In terms of energy consumption, in 2020, slightly more than 24 percent of energy consumption was derived from renewable energy sources, ranking the country 11th in the EU and above the average level for the union.[9] It was a significant increase from the 18 percent of renewables consumption of 2019.[10]

Source: Eurostat

Under the national net metering regime, Romania additionally supports rooftop photovoltaic (PV) development through its Casa Verde Fotovoltaice program for household solar installations.[11]

Finas Group, a green energy market participant based in Cluj, Romania, has created a joint venture with Rinat Akhmetov’s DTEK Renewables International, the largest private energy investor in Ukraine, to develop green energy projects.[12] The collaboration between the two firms began in December 2021 with the creation of a 60 MW wind farm in Ruginoasa, county of Iași.[13] Finas Group and DTEK Renewables International launched a new project in June 2022: a 65 MW PV park on 90 hectares in the town of Glodeni, which will be finished the following year.

According to studies conducted in Romania, the green energy production potential consists of 65 percent biomass, 17 percent wind energy, and 12 percent solar energy, together with 4 percent micro hydropower and 2 percent geothermal.[14]

Romania’s area is divided into eight zones based on the energy potential of biomass: Danube Delta (Biosphere Reserve), Dobrogea, Moldavia, Carpathian Mountains (Eastern, Southern, Apuseni), Transylvanian Plateau, Western Plain, Carpathian Hills, and South Plain. Even if biomass-based energy production were exceedingly economical, the huge expenditures required to establish and commission a single biomass-fired cogeneration unit pose a significant obstacle.

Regarding hydropower, it is important to note that Romania has included the Pașcani hydropower project in the county of Iaşi on the list of projects eligible for EU grants. In 2018, when the dam and hydroelectric facility were 90 percent complete, construction ceased.

It is anticipated that the reservoir will hold 68.7 million cubic meters of water. It should provide water for industrial needs and irrigate 46,000 hectares. An estimated 81 million euros are needed to finish the project in north-eastern Romania. The hydropower portion of the project is a 12 MW unit.[15]

European Cooperation

In response to the COVID-19 crisis, the European Commission developed the Recovery and Resilience Mechanism in order to provide Member States with effective and meaningful financial assistance to expedite the implementation of sustainable reforms and related public investment. The goal of the NRRP is to promote sustainable growth by accelerating the implementation of sustainable reforms and accompanying public investments and by supporting the transition to a green and digital economy.[16] Beneficiaries (direct and indirect) include SMEs, major corporations, local public authorities (LPAs), and administrative-territorial entities (ATUs).

The Modernisation Fund (MF) is a European Union program that assists ten EU member states with lower incomes in achieving their climate neutrality objectives by modernizing energy systems and increasing energy efficiency. Bulgaria, Croatia, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, and Slovakia are the beneficiary Member States.

The European Investment Bank Auctions European Union Allowances of the Modernisation Fund, evaluates proposed investments by beneficiary Member States, manages revenues, and transfers resources.[17] An example of a fund-supported investment in Romania is the development of eight photovoltaic parks and two combined cycle gas turbines, which will replace lignite with renewable energy and gas sources for power generation, as well as modernize electricity networks.

Current contingencies are shaping a greater and growing future for the Romanian energy sector, which will become ever more strategically important. Through a lasting cooperation with European partners and resilient public policies that aim at diversification and green transitioning, forecasting Romania becoming one of the few EU net exporters of energy in the next years is not such a hazardous wager.

Sources

- https://www.worldometers.info/gas/romania-natural-gas/ ↑

- https://www.argusmedia.com/en/news/2396481-romania-becomes-net-gas-exporter ↑

- https://www.energate-messenger.com/news/223855/romania-sends-more-natural-gas-to-ukraine-and-moldova ↑

- https://www.radiosvoboda.org/a/news-moldova-gas-iz-rumuniji/32162916.html ↑

- https://www.euractiv.com/section/energy/news/romania-will-start-extracting-gas-from-black-sea-in-2026-minister-says/ ↑

- https://world-nuclear.org/information-library/country-profiles/countries-o-s/romania.aspx ↑

- https://balkaninsight.com/2020/05/27/romania-cancels-deal-with-china-to-build-nuclear-reactors/ ↑

- https://balkangreenenergynews.com/romania-to-significantly-increase-2030-renewables-target/ ↑

- https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Renewable_energy_statistics ↑

- https://www.irena.org/-/media/Files/IRENA/Agency/Statistics/Statistical_Profiles/Europe/Romania_Europe_RE_SP.pdf ↑

- https://www.afm.ro/sisteme_fotovoltaice.php ↑

- https://www.energynomics.ro/en/2-projects-in-development-for-finas-group-and-150-million-euros-investment-plan-in-renewables/ ↑

- https://www.bursa.ro/finas-group-si-dtek-renewables-international-investitii-de-150-de-milioane-euro-in-energie-din-surse-regenerabile-68981848 ↑

- https://www.trade.gov/country-commercial-guides/romania-energy ↑

- https://balkangreenenergynews.com/romania-to-complete-dormant-pascani-hydropower-project-with-eu-funds/ ↑

- https://ec.europa.eu/info/business-economy-euro/recovery-coronavirus/recovery-and-resilience-facility/recovery-and-resilience-plan-romania_en ↑

- https://climate.ec.europa.eu/eu-action/funding-climate-action/modernisation-fund_en ↑