Poland’s Digital Economy and Society Index

There are many ways to quantify the level of adaptation of a country’s industry to the Industrie 4.0. Having regard to the fact that the first condition for any industry to be compatible with this fourth revolution is digitalisation, it is a good idea to investigate Poland’s level of digitalisation, and to compare it to other countries of the EU. The Digital Economy and Society Index (DESI) was created by the European Union in order to compare all the EU member states’ level of digitalisation, in order to monitor the results and help governments prioritise their investments for development.

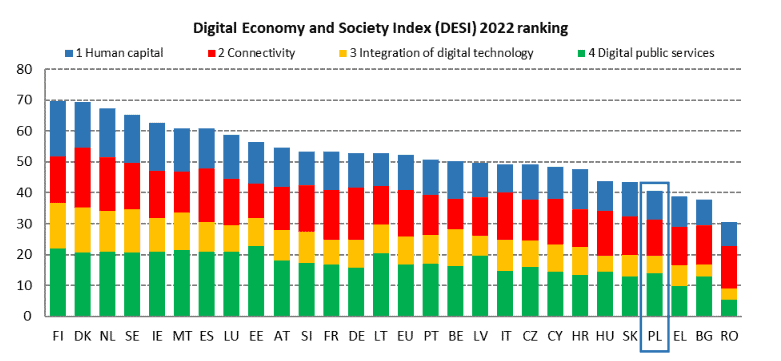

Digital Economy and Society Index (DESI) 2022 ranking

Source: European Commission

As seen on figure 4.6, Poland is one of the worst scoring countries in the EU in terms of digitalisation, as it ranks only 24th out of 27 countries. This is caused to a large degree by its human capital itself (only 42% of Polish people have at least basic digital knowledge and skills, compared to 54% in the EU, European Commission, 2022). The companies are also to blame, as only 18% of them provide basic ICT (Information and communications technology) training (European Commission, 2022).

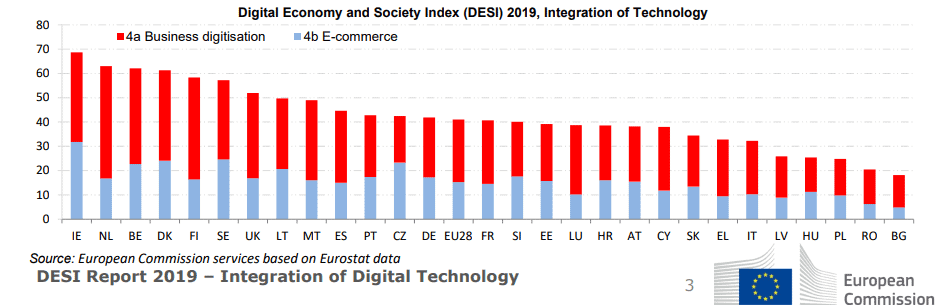

Integration of Technology in EU countries (DESI, 2019)

As seen on Figure 4.7 Poland in 2019 was also ranked 24th in the EU in terms of integration of digital technology – only 40% of Polish small and medium enterprises (SME’s) have integrated at least basic digital technology, which is 15% lower than the EU average. There are still a lot of efforts to be made in order to be able to reach the EU goal which is for every member state to have 75% of their companies using Big Data, cloud services and Artificial intelligence, by 2030. In order to catch up the other member states as quickly as possible and to be able to reach this goal of 75% by 2030, the Polish government has announced various measures and plans in order to boost the digital conversion of Polish companies – those will be discussed in the next section “perspectives for Poland”, next chapter.

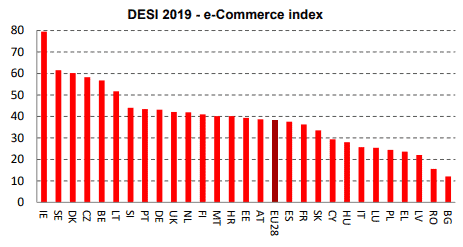

E-commerce Index in EU countries

Source: Eurostat

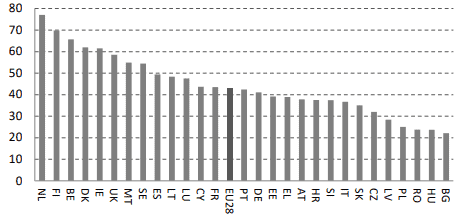

Another factor showing Poland’s delay in digitalisation is e-commerce. Figure 4.8 shows that Poland has the 5th lowest result in the EU with only 25% of SMEs using e-commerce,Balbix, 2019), which represents an important part of the fourth industrial revolution’s scheme, as consumers having adopted the habit of ordering items online makes the transition towards Smart Production more easily. Achieving a high rate of conversion to e-commerce allows to reach this advanced stage of the Industrie 4.0 adoption, which implies the communication of the consumer with the machines of the product he has ordered via the use of sensors. Poland is once more far below the EU average, with only 24% of Polish SME’s (5th lowest result) having e-commerce services. Moreover, as seen on Figure 4.9, only 25% of those SME’s (Integration of Digital Technology, n.d.) (4th lowest result in the EU) use big data analysis, electronic information sharing, cloud solutions, or social media.

Percentage of Polish SMEs using big data analysis, cloud solutions, electronic information sharing or social medıa, 2018

Source: European Commission

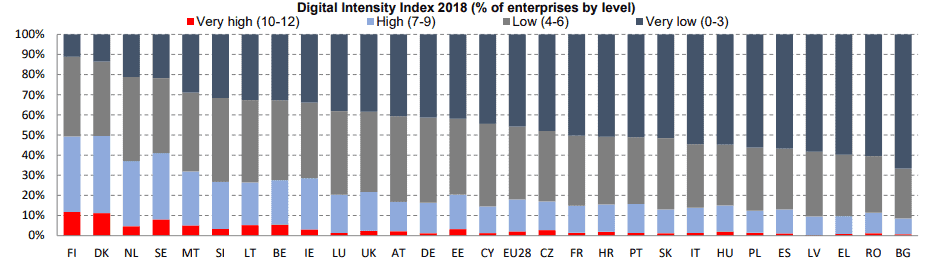

As seen on Figure 4.10, Poland is slightly less delayed in terms of its digital intensity index than in other digital indexes established by the European Commision, as it only has the 6th lowest result. This index shows the availability of 12 different technologies in enterprises, such as the percentage of enterprises giving access to the internet to at least 50% of its employees, internet advertisement, e-voices, etc.

Digital Intensity Index of EU countries in 2018 (% of entreprises by level)

Source: European commission

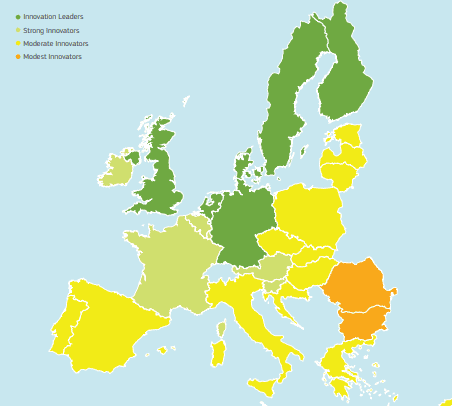

European Innovation Scoreboard 2021

Source : Euraxess

According to the European Innovation scoreboard study, published in 2021, Poland is situated in the category of “Moderate innovators”, together with other Central European countries like Hungary, Czechia and Slovakia (see figure 4.11). The fact that Poland is not exploiting its innovation potential fully is explained by the fact that compared to the EU average, Poland has a higher proportion of its population working in agriculture and a smaller proportion working in manufacturing. However, the European study mentions that Poland’s higher than average GDP growth rate is a positive sign. Moreover, according to the same study, Innovation performance has increased by 2% relative to that of the EU since 2010. Moreover, according to the “Smart Industrie Polen 2017” survey, commissioned by the Ministry of Development and Siemens, in 2016 around 77% of Polish SMEs implemented at least one solution with the objective of supporting innovation. The most common solution is automation with isolated machines.

The use of 3D printers in Poland

3D printing is one of the key components of the Industrie 4.0. This low cost solution is convincing more and more companies over the years. Indeed, the creation of any product is a long process from the idea to the finished product, and the 3D printers allow to quickly manufacture prototypes, which can be modified and adjusted until the end product is satisfying. 3D printing is much faster than more traditional methods, such as injection moulding for example. With traditional injection moulding, it usually takes 2 to 5 months in order to create the mould itself for the objects, whereas it only takes around 2 to 3 days to make one with a 3D printer (fastrating, n.d.) This time saving allows for the modification of the object if an error is noticed, or even to reprint it if necessary with the improvements.

The speed of production in 3d printing is a big advantage in the product prototyping process. This is why the demand for 3D printers keeps increasing every year. According to the 6th edition of the study “the state of 3D printing” published by Sculpteo in 2020, global 3D printing growth reached 52%, up from 48% in 2019 and 17% in 2015 (Moreau, C. 2020). On the European scale, according to a study from the European Patent Office, patent applications for 3D printing in Europe have increased yearly by 36%.

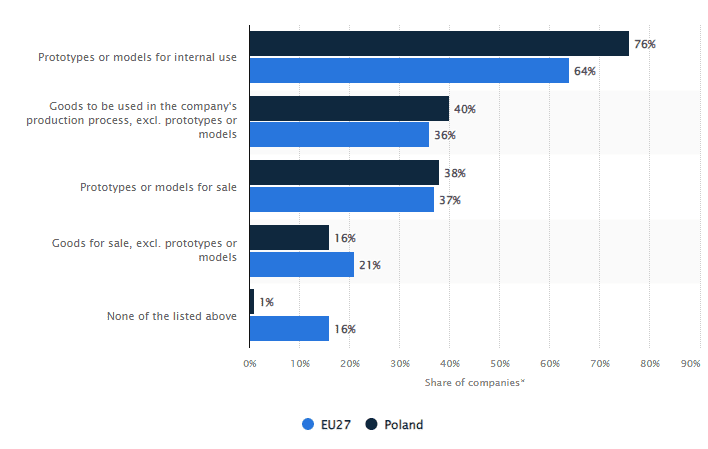

Share of companies using 3D printing in Poland and European Union in 2020, by purpose

Source: Statista, 2022

On this figure 4.11, we can see that the shares of Polish companies using 3D printers for prototype models, goods to be used in the company’s production process, and models for sales (3 out of 5 purposes) are higher than in the European Union, which is a sign that Poland is already on the good way to improving its performance wıth regards to robotisation. Although the global use of 3D printers in Poland accounts for only 1% of the total yearly industrial production (Science in Poland, 2022). According to Prof. Helena Dodziuk who wrote Druk 3D/AM, it is yet to grow (Tomala, 2020). Moreover, Polish 3D printing companies are overrepresented worldwide proportionately to their population, which is mainly due to the quality of Poland’s numerous technical universities and flows of investment from Western countries within the EU (Stevenson, 2017). This means that Polish companies have already on their soil a huge potential for 3D printing growth, and it is likely this new technology will keep growing in Poland.

Automation and Robots

The automatisation of industrial processes with the implementation of robots is an essential element of the Industrie 4.0 as it is the first step to a fully automated production line linked to the Internet of Things, and it is growing globally. On the European scale, this trend is particularly visible in Poland. Robotisation allows for very significant production cost savings, increases the flexibility of the manufactures’ lines of production, and it contributes to replacing humans with machines on labors that are repetitive and often dangerous. Nonetheless, many manufacturers in Europe are still hesitant to implement the changes necessary to automatise their line of production, due to the high costs linked to investment and renewal of their material, as well as the efforts needed to catch up with the modernisation of processes.

In 2022, Poland is still far behind its neighbours in terms of the automatization of its industry, having only 42 robots per 10,000 workers, compared to 338 in Germany and 135 in Slovakia (Wobit, n.d.). However, according to the International Trade administration, 30% of Polish companies are willing to invest in robots in the close future. The positive dynamic seems clear: in 2018, the increase in global sales of robots represented 6%, compared to 40% in Poland.

As specified by the International Federation of Robotics, the number of Robots in the Polish Industry increased by a whopping 40% in 2018 compared to the previous year. In 2018, Poland became the 16th country most automated (in terms of density of robots) in the world, thanks to its total number of robots amounting to 13 600. However, Poland still has a margin of growth, as in 2020, only 6% of Polish small and medium enterprises and 22% of its large enterprises utilise robots, compared to the European Union average, which amounts to 7% of robotisation for Small and Medium Enterprises, and 25% of robotisation for larger enterprises (International trade agency, 2020).

The Industrial Trade Administration states that in the following years, Poland’s number of robots and thus its density will increase, according to models (International trade agency, 2020). Until now, robots in Polish manufacturing are mainly used for the automotive sector (38,6% of robots being used for this sector), the chemical sector (18,9% of robots) and metallurgic sector (12,8%), according the Polish Economic Institute (trade.gov, 2020).

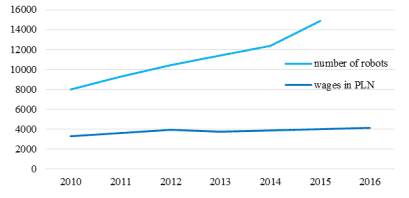

Figure 4.13: Growth of robots in Poland number compared to wages (2010-2016)

Source: Comparison of the Level of Robotisation in Poland and Selected Countries, including Social and Economic Factors, 2916 p.209

In 2013, 13% of Polish firms described themselves as non-automated; in 2016, this proportion fell to only 3%, which is a very good result (S-GE, 2018). Moreover 26% of firms described themselves as fully automated, in 2013 this number amounted to only 13%. These changes are partly due to developments in the labour market. Moreover, Poland has many innovative and efficient companies producing robots. For example, WObit, a Polish producer of automated guided vehicles – or AGVs – has won awards for its range of products. These robots already operate in warehouses and when combined with smart pickers or co-bots (collaborative robots,Wobit, 2021).

According to Radoslaw Miskiewicz (2019), Inn 2017, the yearly sales of robots in Poland went up by 16%, with 1,891 robots sold, and as seen on figure 4.13, the number of robots in the Polish Industry has almost doubled, from 8 000 to 15 000 (Smieszek, Dobrzanski, Dobrzanska, 2019). However, Poland’s limited workforce restricts Poland’s progress in automation, as its robotization proportion is lower than its Central European neighbours which have generally similar labour costs, and this delay can only be caught up significantly with the help of government’s investment plans, which are discussed in the last section of this thesis.

Artificial Intelligence

The rise of artificial intelligence is bringing significant gains to Industrie 4.0. This is true not only in terms of cost and productivity, but also in terms of improved working conditions and safety, as well as quality. By controlling the data and therefore the flows, the manufacturers can organise their production chain, integrate new processes and gain in productivity, in order to respond more quickly to demand while optimising its costs and thus increase its competitiveness. In addition, together with the automation analysed in the section above, artificial intelligence allows factories to focus on higher value-added activities by freeing employees from repetitive and time-consuming tasks.

Concerning the development of Artificial Intelligence and its implementation by manufacturers, Poland is evolving in a particular context. The low presence of Big Tech giants (more commonly known as GAFAM – Google Amazon Facebook Apple Microsoft) in this country implies that the development of artificial intelligence takes place at the startup level. The 3 largest AI startups in Poland are Nomagic, Infermedica and Molecule.one with respective budgets of $30.6 millions, $13,7 millions and $5 millions (www.ai-startups.org, n.d.)

Moreover, Poland can count on a large number of experts working on the question of AI. Indeed, Poland is the best country in the Central and Eastern European countries in terms of the number of these experts, and the 7th in all the European Union, which shows the efforts put in place to become a regional leader in Artificial Intelligence (Industry Europe, n.d.). According to the Polish Investment and Trade Agency (PAIH, 2021) the AI sector in Poland will continue to grow in the future, thanks to its high number of skilled labour, as well as Poland’s highly attractive initiatives for Research and Development, including tax incentives, grants, and EU schemes.

Implementation perspectives for Poland

According to the study “Industry 4.0. The new industrial revolution – how Europe will succeed”. Poland is a “hesitant country” in terms of readiness for the implementation of Industrie 4.0 technologies, having a rather low index of readiness according to other countries. However, the Polish Central Bureau of Statistics (GUS) states that the Polish manufacturing industry has an overall positive tendency. Indeed, on the microeconomic level, 66.3% of industrial companies are planning to make important investments in 2022, compared to only 45.6% in 2016 (Industry Europe, n.d.).

However, in spite of the will from manufacturers to modernise their industry in order to adapt them to the Industrie 4.0, which is shown by the increase in investment for automation, it is impossible for them to “catch up” with other European countries by themselves. This is why the Polish government has multiplied its efforts to revolutionise the Polish industry, namely by supporting manufacturers through various plans, and by supporting Research and Development in order to maximise the conditions for innovation.