This contribution was originally presented by Blue Europe Fellow Marceli Hazla at the “Three Seas One Opportunity: Toward a New Intermarium” conference and won the best paper award for its insightful and documented perspective.

Introduction

Just as the beginning of the 1990s was dubbed the ‘end of history’[1], the aggression of the Russian Federation against Ukraine on 24 February 2022 marked the ‘end of holidays from history’. In a short period of time, the whole of Europe was forced to revise its previous paradigms of international cooperation, both economically and politically. Indeed, during the three decades of progressive globalisation and economic integration following the collapse of the Soviet Union, EU countries were keen to benefit from the advantages of the international division of labour and the outsourcing of production, becoming increasingly dependent on Russian energy resources, Chinese manufacturing capacity and Taiwanese semiconductors. The Russian aggression against Ukraine, still not condemned by the Middle Kingdom, has exposed the scale of this dependency – and forced the Old Continent to seek alternative solutions. In the light of this analysis, a key sector in which the European Union has lost economic sovereignty is the semiconductor industry, which is currently the backbone of modern economies. The aim of the analysis will be to juxtapose this fact with the idea of creating a European hub for semiconductor production in Poland and Ukraine, which could provide an answer to this challenge.

European dependences

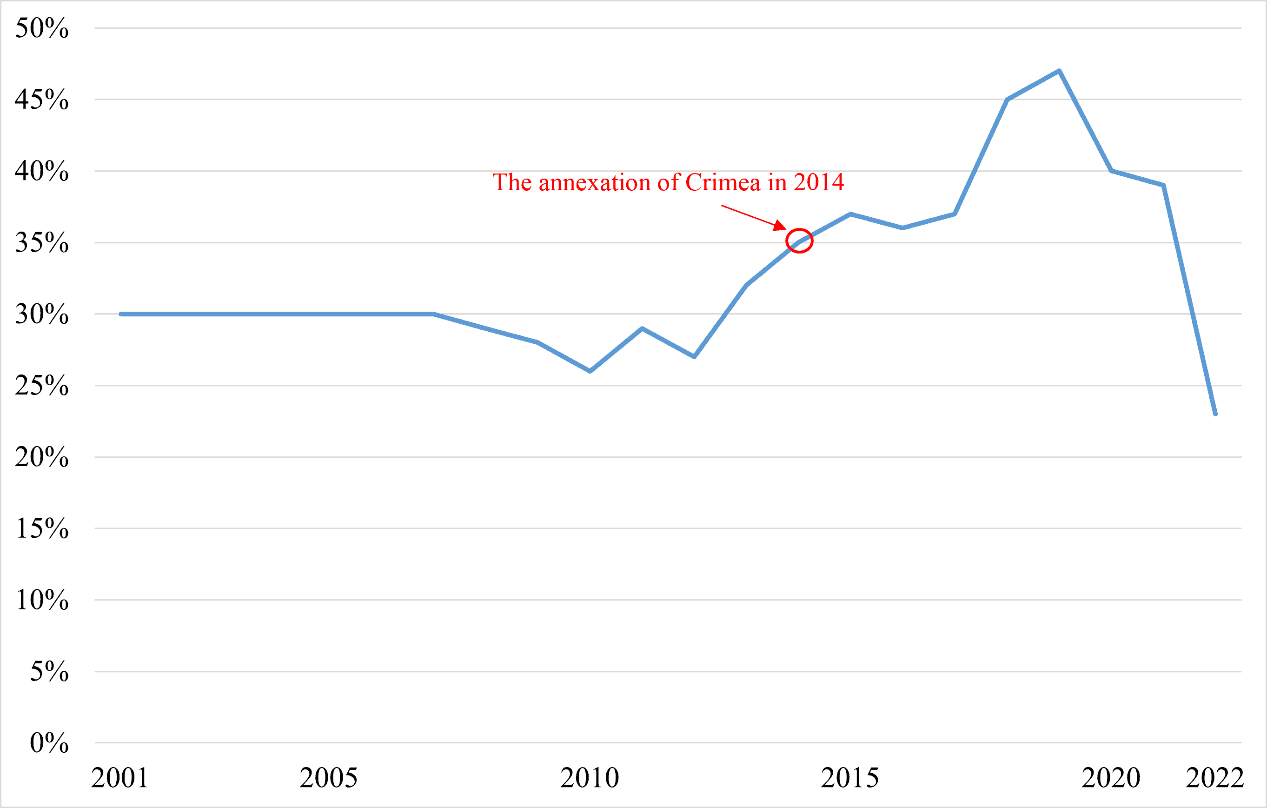

The first issue, which provides the context for further ones addressed in the text, is related to European dependence on Russian gas, as over the course of the 21st century, European Union member states have become increasingly dependent on it. Between 2001 and 2019, the percentage of the total gas demand of member states met by Gazprom increased from 30 per cent to 47 per cent – worse still, this trend did not change even in 2015 after the annexation of Crimea (Figure 1). Not surprisingly, in the absence of a decisive response from EU countries, imperial ambitions grew in Russian President Vladimir Putin, culminating in the launch of an invasion on 24 February 2022. Only then did all EU countries realise the seriousness of the situation and the degree of dependence on Russian raw materials. The March Declaration of Versailles therefore pointed out the need to become independent of Russian energy resources and thus accelerate the development of renewable energy sources[2].

Figure 1: Share of European Union gas demand met by Russian supply, 2001-2022

Source: International Energy Agency, Share of European Union gas demand met by Russian supply, 2001-2022, “International Energy Agency”, 22.02.2023, https://www.iea.org/data-and-statistics/charts/share-of-european-union-gas-demand-met-by-russian-supply-2001-2022 [accessed: 08.10.2023]

In view of European plans to achieve climate neutrality by 2050, the dynamic development of renewable energy sources and the plethora of alternative suppliers (including the US, Norway, Denmark, Egypt, Turkey and others), a shift away from Russian gas is a rather short-term, transformational issue. In the long term, it may even contribute to the increased competitiveness of EU economies[3]. Therefore, while it may be relatively easy to solve this problem, this issue has been a kind of awareness-raising factor, thanks to which the loss of the EU’s economic independence has begun to be widely discussed[4].

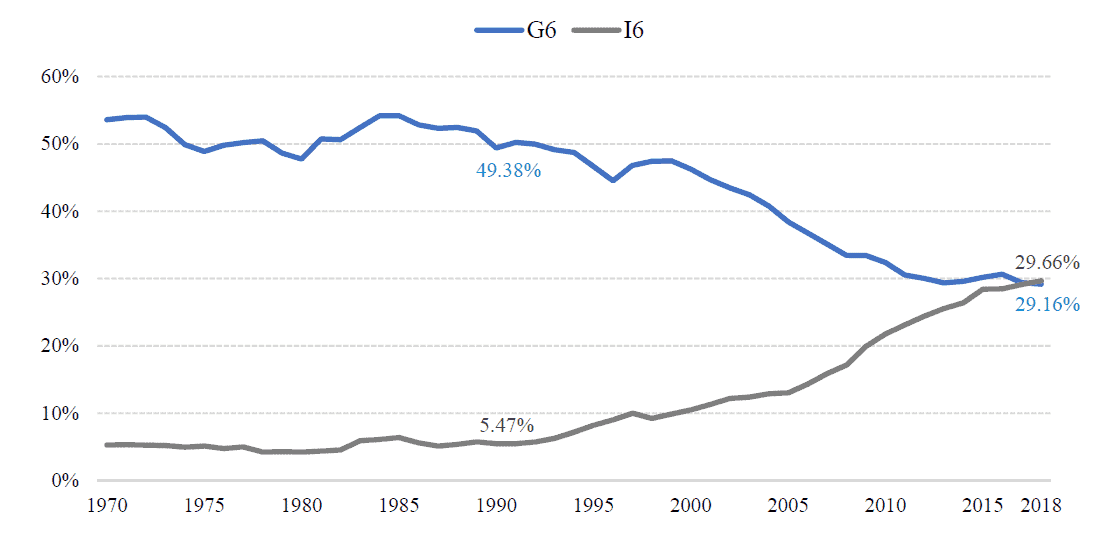

The second issue, however, is already more momentous in its implications, given the greater amount of time required to make changes to it – namely the reliance on Chinese manufacturing capacity and Taiwanese semiconductors. Since the 1990s, an increasing number of catching-up economies have begun to industrialise, taking advantage of international competitive advantages in the form of low labour costs, while developed countries have accelerated the de-industrialisation and servitisation of their economies[5]. European Union countries have also been keen to reap the benefits of the international division of labour and outsourcing of production, ceding much of their industrial sovereignty to developing countries – particularly China. As a result, between 1990 and 2018, the G6 countries’ share of global industrial production fell from 49.38% to 29.16%, while the I6 (abbreviation for ‘Industrialising Six’, namely China, India, Indonesia, Korea, Thailand and Poland) countries’ share rose from 5.47% to 29.66% (Figure 2).

Figure 2: Share of G6 and I6 countries in world industrial production, 1970-2018

Source: M. Hązła & E. Mińska- Struzik, How to assess economic progress in the era of discontinuity?, “Global Policy” 2023, no 14, pp. 331–348, https://doi. org/10.1111/1758-5899.13180

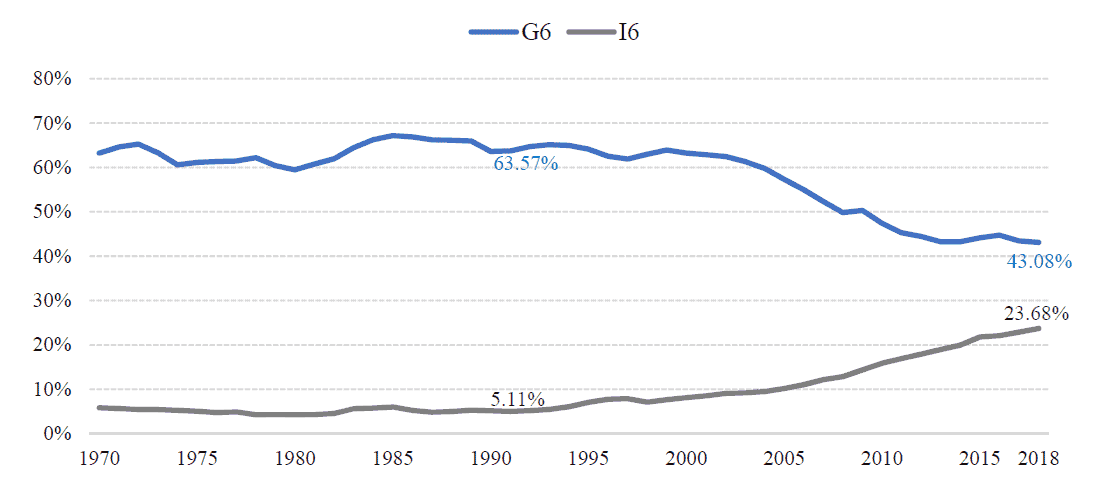

This translated into an equally impressive increase in the share of industrialising economies in world GDP over the identical period, largely at the expense of developed economies. Between 1990 and 2018, the G6 countries’ share of global GDP fell from 63.57% to 43.08%, while the I6 countries’ share rose from 5.11% to 23.68%. China is responsible for the of these changes, with its share in global GDP increasing from 3.1% to 16% in 1970-2018 (Figure 3).

Figure 3: Share of G6 and I6 countries in world GDP, 1970-2018

Source: M. Hązła & E. Mińska- Struzik, How to assess economic progress in the era of discontinuity?, “Global Policy” 2023, no 14, pp. 331–348, https://doi. org/10.1111/1758-5899.13180

China therefore now plays a key role in global value chains. Between 1978 and 2021, its share of total world exports of goods increased from 0.8 % to 15.1 %, which is currently the highest in the world and almost double the share of the second-placed United States (7.9 %)[6]. According to many authors, a key turning point in the perception of this issue became the US-China trade war, since which China began to challenge US hegemony in a more decisive and open manner, as well as aspiring to achieve technological supremacy. To achieve this, however, it will be necessary to dominate the semiconductor market, which is now the backbone of modern economies[7].

Crucial role of microchips in the contemporary global economy

Due to the prevalence of their use, microchips are essential for the operation of industries such as: computers, telecommunications, white goods, banking and finance, cyber security, health service, transport, energy, industry, defense and many others[8]. For example, due to pandemic lockdowns in 2020, delays of 20-52 weeks in microchip deliveries have led to a drop in the value of global exports by hundreds of billions of dollars. Nonetheless, the value of the global semiconductor market grew by 6.6% in 2020, despite a 3.5% decline in global GDP[9]. Control of microchip production thus makes it possible to exert a significant economic influence on the global economy – now even greater than that of oil. This is all the more risky given that microchip production is characterised by very high levels of concentration[10].

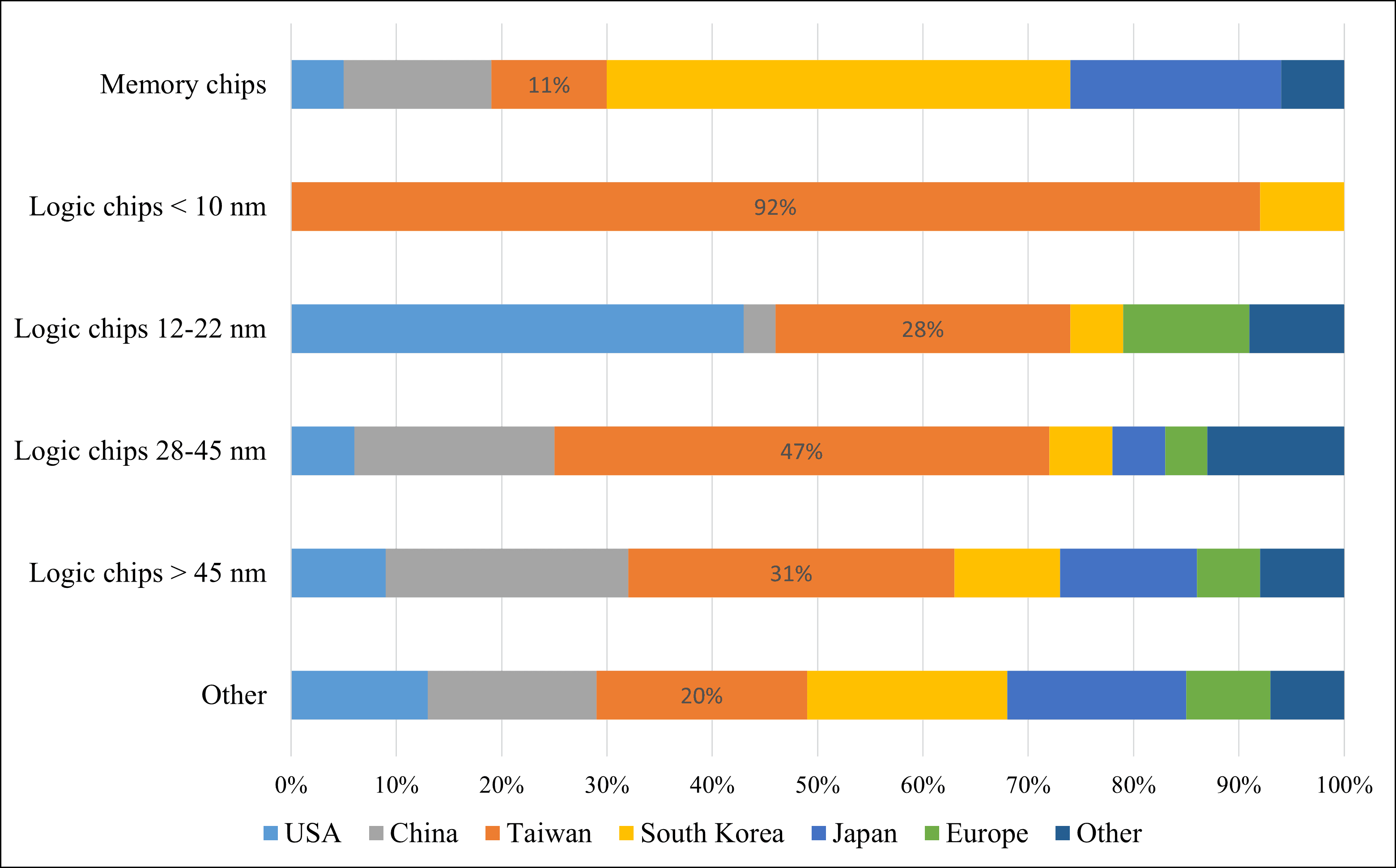

EU member states account for 20% of global demand for microchips, while their share of global production is only 8%. In particular, the most technologically advanced <10nm logic chips are a hotspot, with production taking place almost exclusively in Taiwan (92%)[11] (Figure 4). With growing tensions around Taiwan and Chinese plans to ‘achieve combat readiness to invade’ this ‘rogue province’ by 2027, this means that the European Union faces the risk of a breakdown in strategic supply chains and, consequently, growing economic dependence on China. These problems are reflected in the strategy to increase the European share of global semiconductor production from 9% to 30% by 2030[12].

Figure 4: Global integrated circuit production by region, 2019

Source: A. Varas, R. Varadarajan, R. Palma, J. Goodrich, F. Yinug, Strengthening the Global Semiconductor Supply Chain in an Uncertain Era, New York 2021, p. 35.

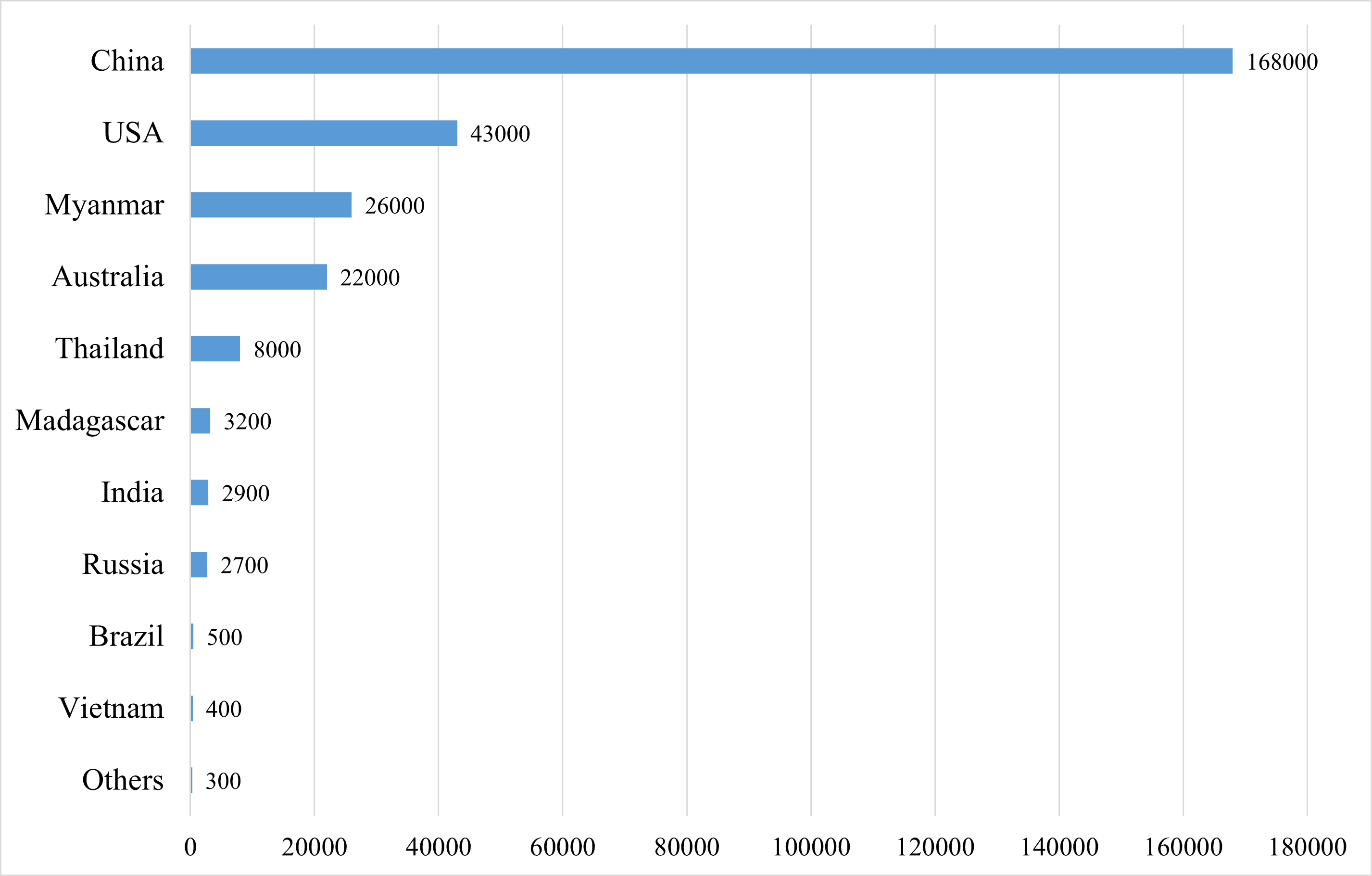

Unfortunately, the production of microchips and other high-tech goods is impossible without access to key raw materials. In particular, rare earth metals (a group of 17 chemical elements; 15 lanthanides, scandium and yttrium) are currently used in many high-tech industries, such as the production of lasers, magnets, chips, catalysts, satellite technology or advanced communications systems, making them essential for the development of digital economies as well as for achieving the green transition[13]. The world is heavily dependent on China for their extraction – in 2021 it accounted for 60% of global production, while the United States only extracted 15% (Figure 5). Countries in Asia and Oceania are responsible for the remainder, meaning that European economies rely solely on imports.

Figure 5: Global production of rare earth elements (Mt), 2021

Source: US Geological Survey database, https://www.usgs.gov/ [accessed: 07.10.2023].

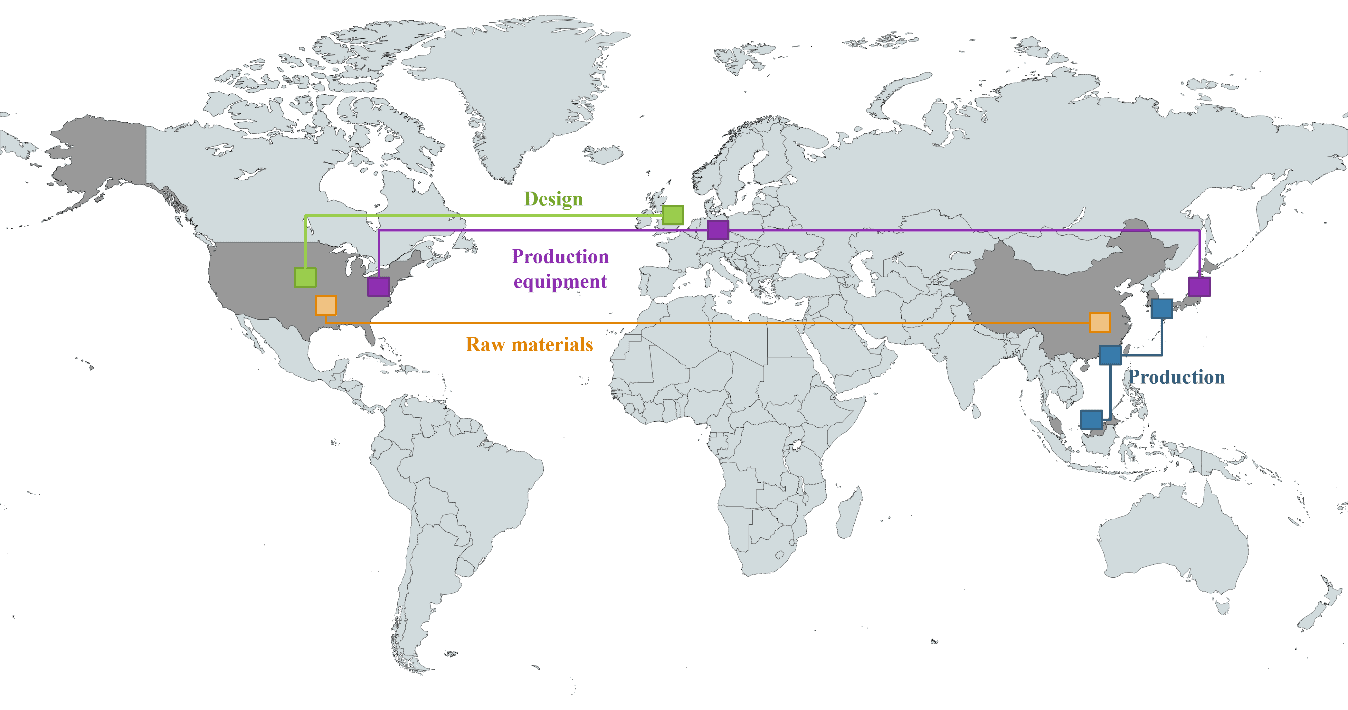

Therefore, as can be observed in Figure 6, which shows the key links in the global semiconductor industry value chain, the biggest barrier for Europe is the lack of access to raw materials – which are currently mined almost exclusively in China and the US, as mentioned above.

Figure 6: Global value chains of the semiconductor industry

Source: MapChart, https://www.mapchart.net/europe.html [accessed: 07.10.2023].

Can closer cooperation with Ukraine solve Europe’s problems?

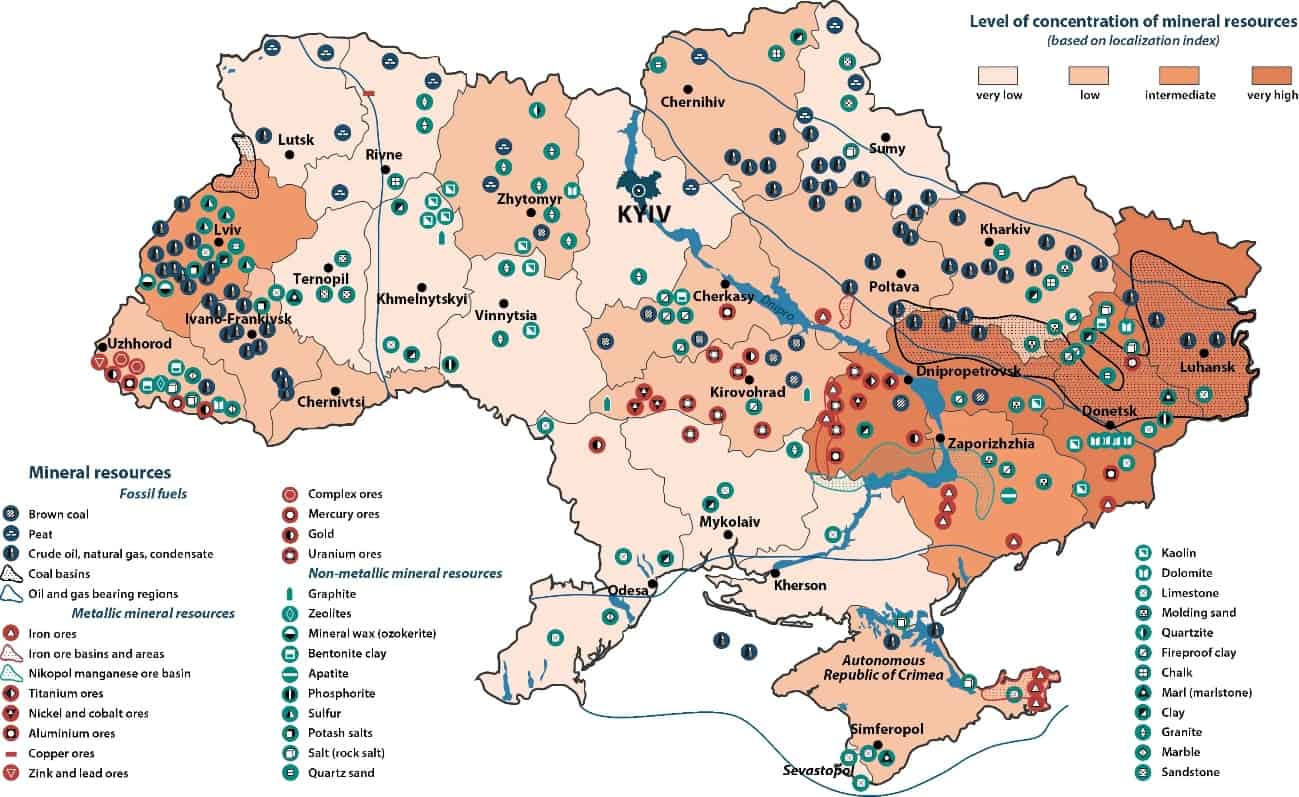

That’s why a closer economic cooperation with Ukraine after the war could potentially be the answer to the aforementioned issues. This is largely due to its reserves of rare earth metals, the total value of which is estimated to be between USD 3 trillion and USD 11.5 trillion, making it the world’s fourth economy (and Europe’s first) in terms of the value of its deposits and opening up the possibility of becoming a ‘raw material superpower’[14]. These also include sizable deposits of lithium, which is the most important element used in ‘green’ technologies such as photovoltaics, lithium-ion batteries and ICT infrastructure. By the same token, this allows the thesis to be advanced that maintaining territorial control over Donetsk and Lugansk is an even more strategically important goal for Ukraine than regaining Crimea, given their highest level of concentration of mineral resources (Figure 7)[15].

Figure 7: Natural resource deposits in Ukraine

Source: R. Muggah, Russia’s Resource Grab in Ukraine, “Foreign Policy”, 28.04.2022, https://foreignpolicy.com/2022/04/28/ukraine-war-russia-resources-energy-oil-gas-commodities-agriculture/ [accessed: 07.10.2023].

In March 2023. The World Bank estimated the total value of the damage caused in Ukraine so far by the Russian invasion at USD 411 billion. This means that after the end of the war, the Ukrainian economy will have to undergo a thorough reconstruction[16]. Indeed, the devastation provides a pretext for the transformation of old sectors such as agriculture, energy and heavy industry towards European standards. In this context, one of the most relevant issues in the coming years will be the question of Ukraine’s potential accession to the European Union. In an expression of political support, Ukraine was granted official candidate status in July 2022[17], marking the first significant breakthrough on this issue (in June 2022, Ukraine also became a partner of the Three Seas Initiative[18]). Although the road to becoming a fully-fledged member of the EU may still take many years, candidate status will contribute to a greater influx of post-war investment than before – for example, for Poland, the Czech Republic, Slovakia and the Baltic states admitted to the EU in 2004, the process of close integration into EU markets began as early as 2000, as a result of the provisions of association agreements and adjustment investments[19].

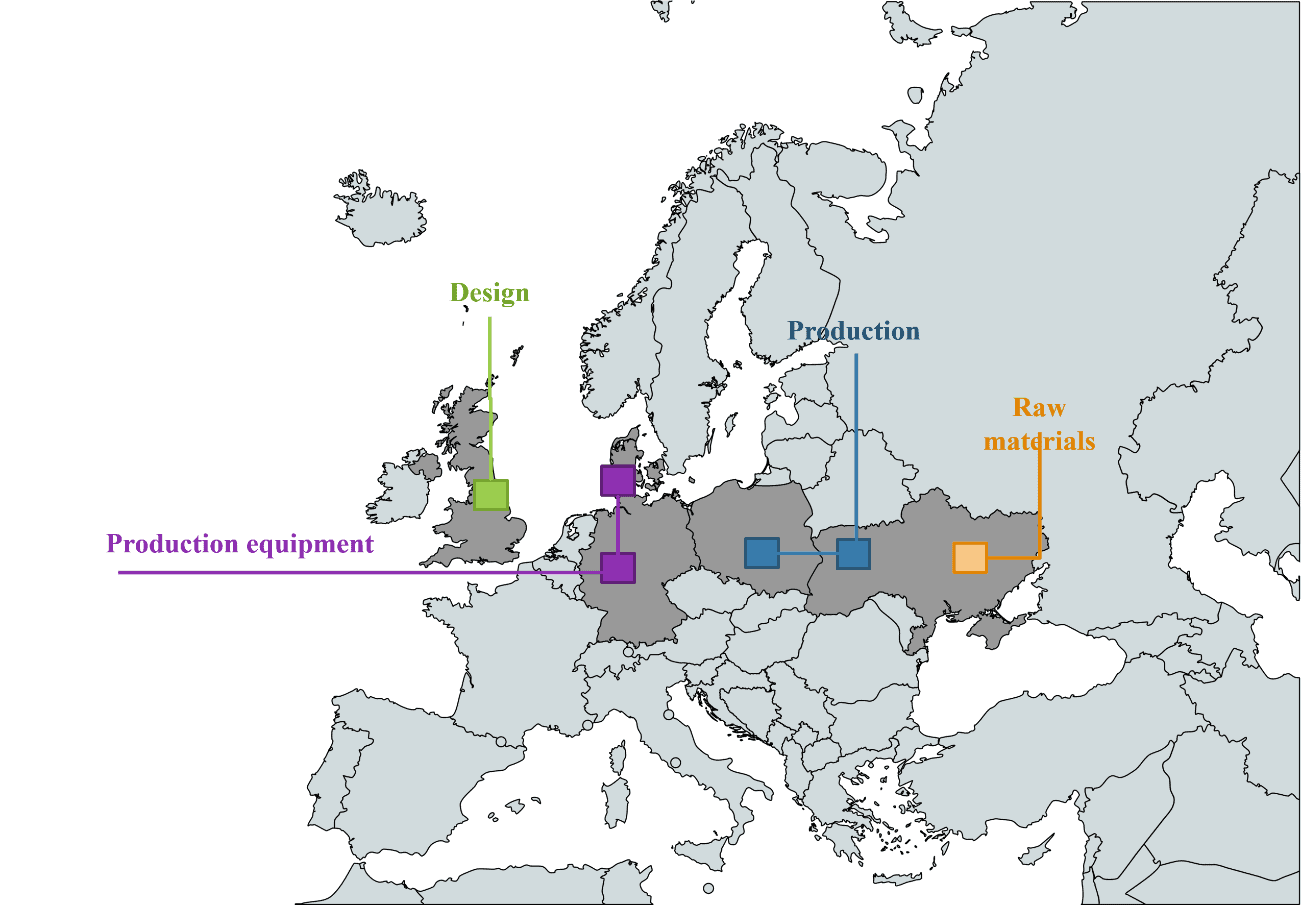

Poland would therefore have an important role to play here, which, through its far-reaching assistance to Ukraine during the war, became its strategic ally and a country whose efforts were recognised by the international community[20]. With costs still below the EU average, Poland is still an attractive location for new investments – and at the same time, due to its relative economic backwardness, it has not yet been affected by the problems of deindustrialisation which have become common in Western European countries since the 1990s. It could thus become the leader of an initiative to promote the creation of a European hub for semiconductor production on the territory of Poland and Ukraine. Figure 8 shows an example of the configuration that a European semiconductor value chain could adopt.

Figure 8: A vision for the European semiconductor value chain

Source: MapChart, https://www.mapchart.net/europe.html [accessed: 07.10.2023].

This would also be a good way of fairly rebuilding the Ukrainian economy, protecting it from being treated as a reservoir of raw materials. Ukraine’s accession to the European Union would also involve a shift in the Community’s centre of gravity from Germany to Poland, which could expand and strengthen its position as a central economic and logistics hub[21]. As a consequence, the importance of the Three Seas Initiative region, whose members will be able to provide complementary industrial infrastructure in the high-tech sector of strategic importance, would also increase[22]. This would mean an opportunity to increase the security of European supply chains in the semiconductor industry and thus the economic security of the continent – at the same time representing an opportunity for the reconstruction and development of the Ukrainian economy, and opening a new chapter in the history of an independent Ukraine.

References

- F. Fukuyama, The End of History?, “The National Interest” 1989, no. 16, pp. 3-18. ↑

- European Union, Informal meeting of the Heads of State or Government. Versailles Declaration, 11.03.2022, https://www.consilium.europa.eu/media/54773/20220311-versailles-declaration-en.pdf [accessed: 08.10.2023]. ↑

- L. Alden, Jak kryzys energetyczny zmienia świat, „Układ Sił” 2022, no. 37, pp. 2-5. ↑

- M. Ruta, How the war in Ukraine is reshaping world trade and investment, “World Bank Blogs”, 03.05.2022, https://blogs.worldbank.org/developmenttalk/how-war-ukraine-reshaping-world-trade-and-investment [accessed: 07.10.2023]. ↑

- R. Baldwin, The Globotics Upheaval: Globalization, Robotics, and the Future of Work, Oxford 2019, pp. 53-86. ↑

- A Nicita, C. Razo, China: The rise of a trade titan, “UNCTAD News”, 27.04.2021, https://unctad.org/news/china-rise-trade-titan [accessed: 07.10.2023]. ↑

- M. Martina, D. Brunnstrom, CIA chief warns against underestimating Xi’s ambitions toward Taiwan, “Reuters”, 03.02.2023, https://www.reuters.com/world/cia-chief-says-chinas-xi-little-sobered-by-ukraine-war-2023-02-02/ [accessed: 07.10.2023]. ↑

- C. Miller, Chip War. The Fight for the World’s Most Critical Technology, New York 2022, pp. 298-352. ↑

- I. King, D. Wu, D. Pogkas, How a Chip Shortage Snarled Everything From Phones to Cars, “Bloomberg”, 29.03.2021, https://www.bloomberg.com/graphics/2021-semiconductors-chips-shortage/ [accessed: 08.10.2023]. ↑

- C. Miller, op.cit. ↑

- A. Varas, R. Varadarajan, R. Palma, J. Goodrich, F. Yinug, Strengthening the Global Semiconductor Supply Chain in an Uncertain Era, New York 2021, p. 35 ↑

- Kearney. Europe’s urgent need to invest in a leading-edge semiconductor ecosystem, Atlanta 2021, p. 24. ↑

- H. Kozieł, Metale ziem rzadkich. Wąskie gardło cywilizacji cyfrowej, “Rzeczpospolita”, 18.02.2022, https://www.rp.pl/plus-minus/art35711091-metale-ziem-rzadkich-waskie-gardlo-cywilizacji-cyfrowej [accessed: 07.10.2023]. ↑

- M. Brewster, Natural gas, rare earth minerals: What’s at stake for Ukraine in the territory Russia is trying to conquer, “CBC News”, 27.05.2022, https://www.cbc.ca/news/politics/natural-resources-ukraine-war-1.6467039 [accessed: 07.10.2023]. ↑

- International Energy Agency, Ukraine energy profile: Energy security, “International Energy Agency”, https://www.iea.org/reports/ukraine-energy-profile/energy-security [accessed: 08.10.2023]. ↑

- S. Blank, Rebuilding Ukraine the right way, “Atlantic Council”, 08.01.2023, https://www.atlanticcouncil.org/blogs/ukrainealert/rebuilding-ukraine-the-right-way/ [accessed: 07.10.2023]. ↑

- European Council, EU enlargement policy: Ukraine, https://www.consilium.europa.eu/en/policies/enlargement/ukraine/ [accessed: 08.10.2023]. ↑

- Institute of Central Europe, The Three Seas Initiative after the Riga summit: a new status of cooperation with Ukraine and the support of the United States, “Institute of Central Europe”, 24.06.2022, https://ies.lublin.pl/en/comments/the-three-seas-initiative-after-the-riga-summit-a-new-status-of-cooperation-with-ukraine-and-the-support-of-the-united-states/ [accessed: 08.10.2023]. ↑

- M. Hązła, Czy Unia Europejska powinna stać się federacją?, „Społeczeństwo i Polityka” 2021, no. 3/68, pp. 67-68 ↑

- PolskieRadio, Poland will help rebuild Ukraine after war ends: deputy PM, “Polskie Radio”, 09.05.2022, https://www.polskieradio.pl/395/9766/Artykul/2954748,Poland-will-help-rebuild-Ukraine-after-war-ends-deputy-PM [accessed: 08.10.2023]. ↑

- R. Bossong, O. Geden, A. Härtel, R. Kempin, K.O. Lang, B. Lippert, C. Luden, N. Ondarza, B. Rudloff, Ukraine’s possible EU accession and its consequences, “Stiftung Wissenschaft und Politik”, 22.07.2022, https://www.swp-berlin.org/en/publication/ukraines-possible-eu-accession-and-its-consequences [accessed: 08.10.2023]. ↑

- President of the Republic of Poland, Declaration of the Seventh Three Seas Initiative Summit, “President.pl”, 20.06.2022, https://www.president.pl/news/declaration-of-the-seventh-three-seas-initiative-summit,55642 [accessed: 08.10.2023]. ↑