Thanks to their flexibility and innovation, FinTech companies can help accelerate the spread of ESG principles in everyday life. We are still in the early stages of true FinTech, as the future impact of cloud computing, IoT, artificial intelligence and blockchain cannot even be calculated today. Every year, digital businesses are penetrating deeper into the financial services value chain and also creating new market structures in underbanked emerging markets. Pure FinTech companies are now sharing the market with some banks, offering innovative, digital-friendly banking services and integrating digital payments, microfinance and robo-advisor services into existing bank accounts.

ESG, i.e. environmental protection, social responsibility and corporate governance, have entered the mainstream discussion in recent years, occupying a growing share of attention from the media, commentators and policy makers. Indeed, in addition to existing soft recommendations like the 2015 Sustainable Development Goals, a concrete legal framework has begun to emerge in member state economies as a result of the European Parliament’s adoption of the EU Taxonomy in 2020. With the growing need to integrate sustainability rules into social life and business activities, more and more industries are trying to add their bit to the green transition – the situation is no different in the financial industry.

Polish FinTech: a growing sector

The world’s largest banks such as Goldman Sachs, JP Morgan and Wells Fargo have for several years been publishing reports on the ESG and sustainability assessment of the activities of the companies they fund. In Poland, the most ambitious goal has been set by Bank Ochrony Środowiska, which plans to stop financing companies with negative CO2 emissions by 2030. However, widespread implementation of changes on such a large scale takes time – according to the European Green Deal, member state economies should achieve climate neutrality only in 2050. This will also require significant expenditure – according to Marek Wadowski, vice-president for finance at Tauron Polska Energia, achieving zero emission in the Polish energy sector alone will require investments of approximately EUR 180-200 billion. Thus, in the coming years, the cooperation of all three parties will be necessary; the financial sector, the government and the European Commission.

However, the activities of large financial institutions are mainly concerned with environmental and corporate governance issues, while social responsibility is addressed by them mainly indirectly. This is both due to the lack of direct contact with consumers of many of them and echoes the strained confidence in the financial sector after the 2007-2009 crisis.

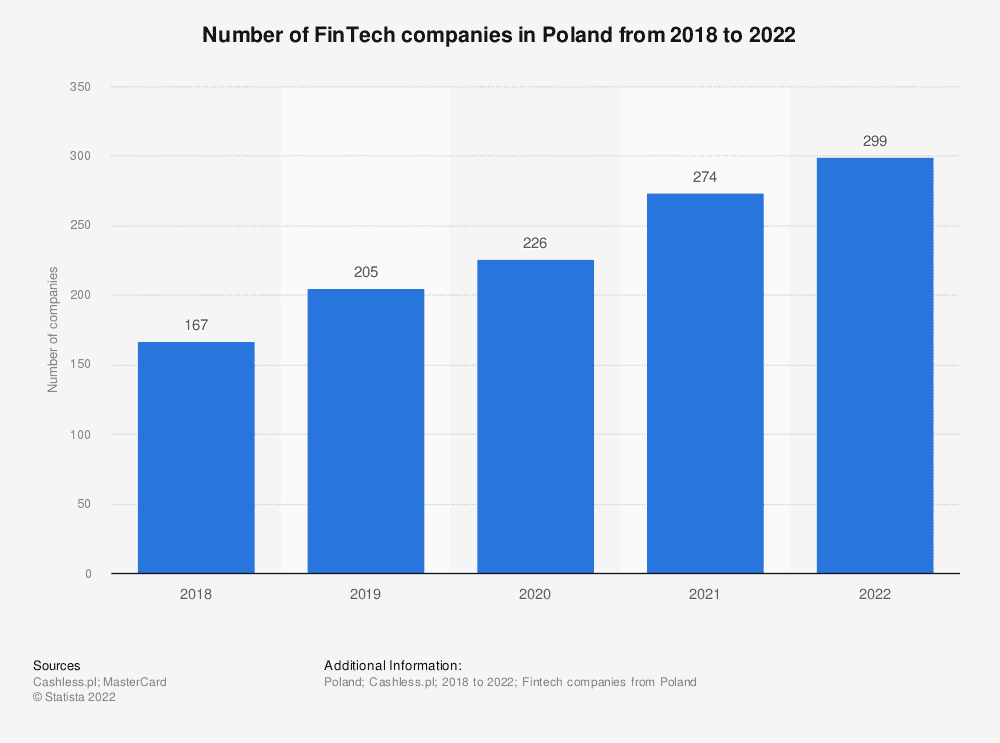

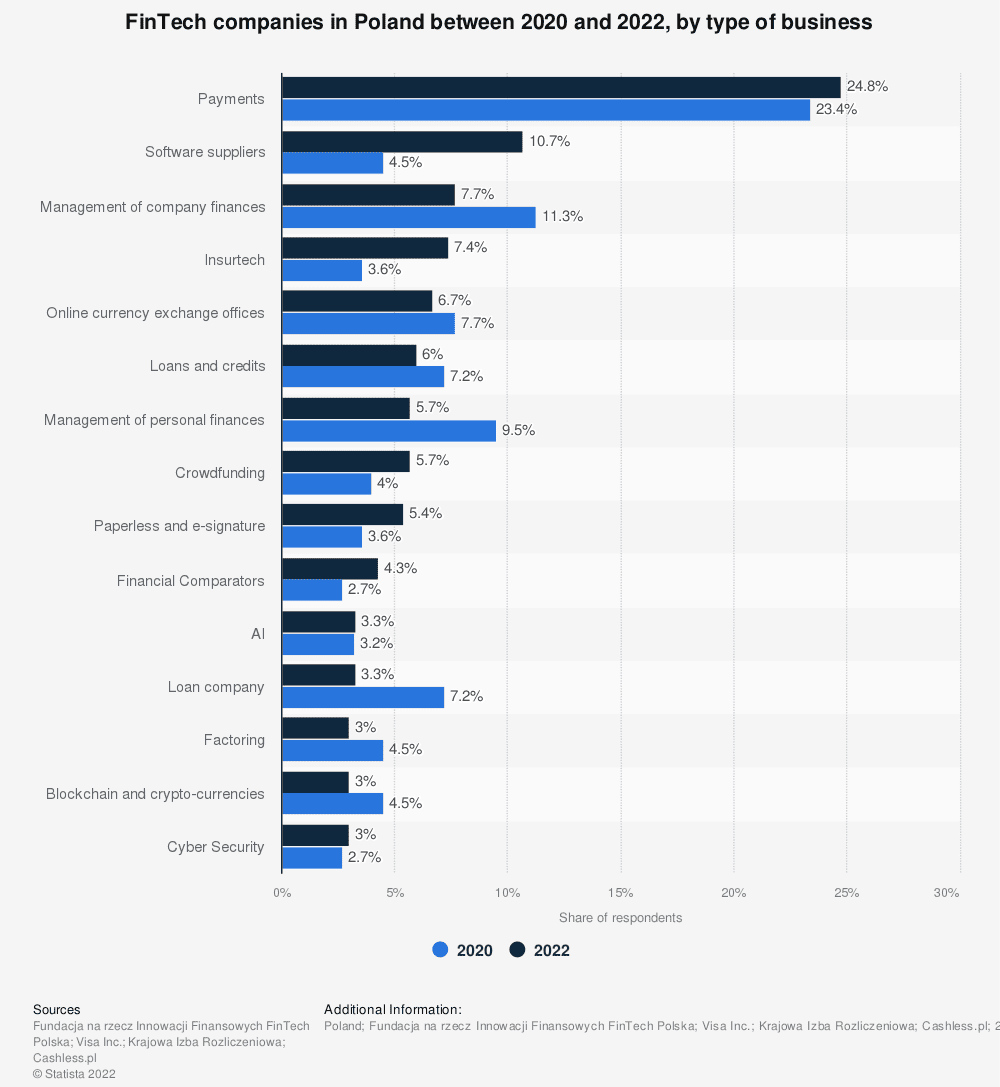

This can be helped by FinTechs, whose importance in the Polish financial sector has grown significantly over the past few years. These are companies that combine financial and technological solutions, usually using online channels. According to the report ‘map of Polish fintech 2022’, there are currently already 299 such companies operating in Poland, with more than half of them established after 2017. The activities of the largest part (74) mainly concern payment processing, but some also deal with corporate financial management, crowdfunding, cyber security or factoring. The increase in their importance, in turn, is a direct result of the growing digitalisation of the Polish economy – according to a study by the Poland Without Cash Foundation between 2016. 2021, the share of cashless payments in retail transactions increased from 32% to 57% and from 2017 to 2023, the share of e-commerce in retail is expected to increase from 5.3% to around 20%.

Future FinTech market trends

Although, nationally, the share of cashless payments in retail transactions is likely to reach its maximum soon – as the majority of Poles (53%) appreciate the choice between cash and cashless payments, according to a study by the Warsaw Banking Institute – there is still significant room for the development of FinTechs offering services of a different kind.

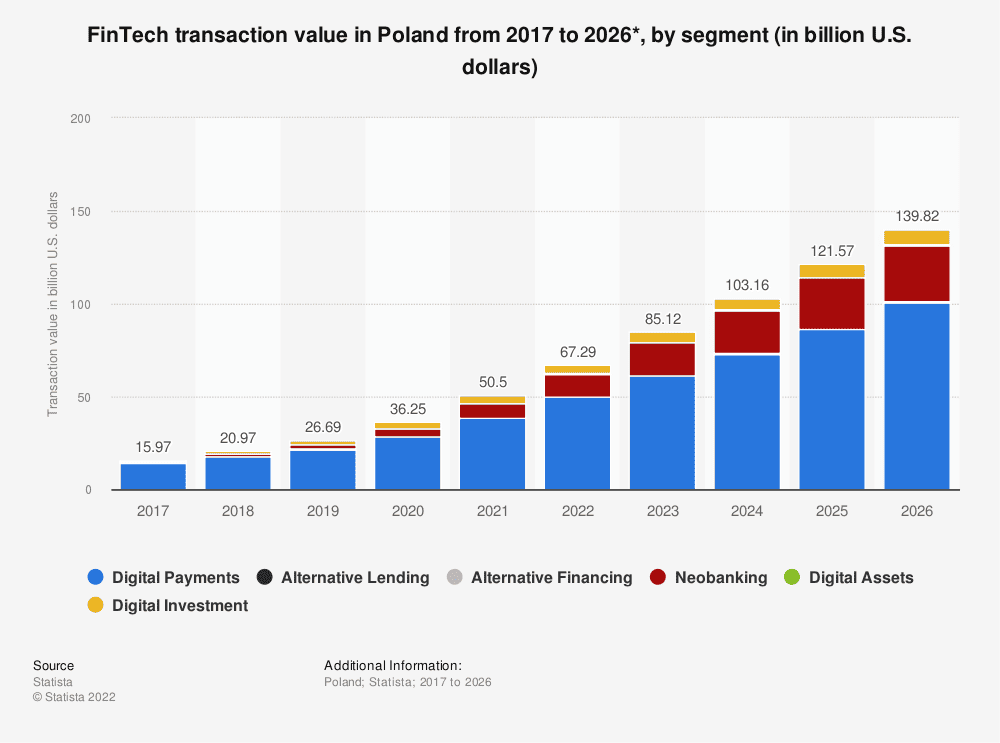

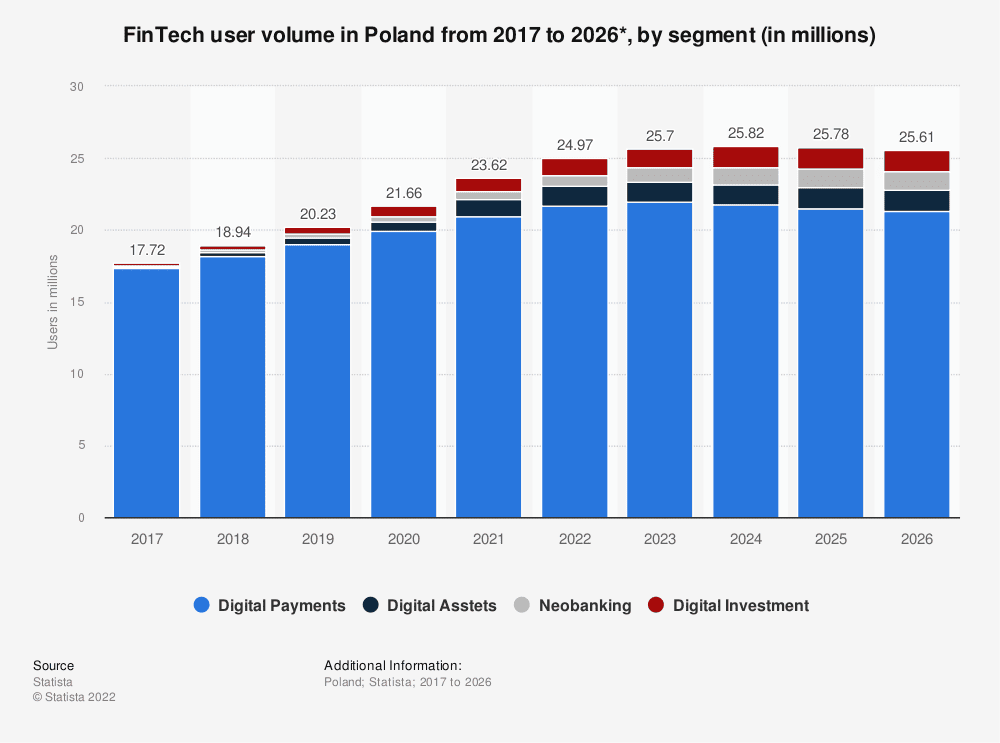

Projections for 2026 forecast a scenario of growing FinTech transactions, particularly for Digital Payments and Neobanking. Notably, this will occur despite the FinTech market reaching a maximum of user volume around 2024. It will probably enhance competition in the sector, as more services will be offered to the same unique user.

According to a report by the DigitalPoland Foundation, 52% of Poles believe that investments and savings that contribute to ESG realisation and have a positive impact on the climate and the environment should yield the same return or even more than investments that do not consider ESG goals – a percentage that rises to as high as 80% in the 18-34 age group. At the same time, due to the EU Taxonomy and other regulations in the financial sector, there will be a growing pool of ESG-compliant companies in the coming years that are, so to speak, ‘certified’ by the banks that finance them. Operating among these companies, FinTechs could create green equity, bond as well as mixed portfolios, enabling environmentally sensitive consumers to allocate their savings while providing green companies with funding – thus combining all three ESG spheres.

Other examples of FinTech spheres of activity could include electronic signatures (contributing to paper savings), managing a household budget (for example, pointing out opportunities to reduce energy consumption), outsourcing IT processes to the cloud (reducing the carbon footprint through economies of scale) or allocating a percentage of revenue generated from advertising to planting trees.

In this way, sustainable FinTechs can become a catalyst for ESG principles in the Polish financial sector, complementing the activities of banks and other large institutions. Indeed, the dissemination of ESG principles in everyday life will be essential to meet the ambitious goals of the European Green Deal.