You can find our previous analysis on the Polish gaming industry HERE

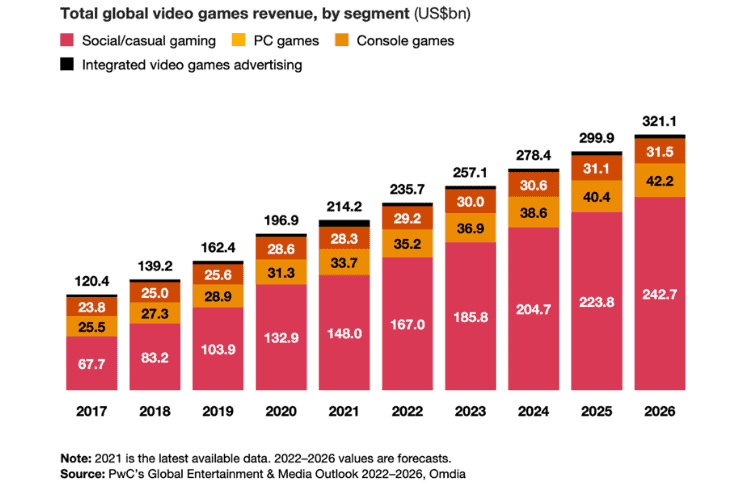

If you’re not a gamer, chances are you will be soon. The video game industry is thriving and expected to continue to grow, with the global gaming business estimated to be worth $321 billion by 2026. Social and casual gaming are driving the expansion after millions of people picked up controllers to escape the boredom and isolation of COVID-19 lockdowns. Some gamers found that playing video games improved their mental health during the lockdown. According to a survey of European gamers, 16% felt this way, with those who spent time playing multiplayer genres feeling particularly good.

During the pandemic, so many existing and new gamers spent money on games, consoles and other equipment that the market is set to grow by 26% between 2019 and 2021. We could almost say that the gaming industry is awash in cash.

Some games benefited from well-timed launches. Animal Crossing: New Horizons, released by Nintendo in March 2020, sold 13.4 million units in its first six weeks. It went on to become one of the most popular Nintendo Switch games of all time. According to the Harvard Business Review, while the lockdown may have turned millions of us into gamers, adapting to work-from-home (WFH) has presented unforeseen creative hurdles for those in the gaming industry.

The tech-savvy workforce, which deals almost exclusively in digital goods, might have been expected to transition easily to WFH. In some cases, however, a lack of spontaneous participation has hampered product development, and highly regarded new games have been released weeks or months late. Several game companies have lost millions of dollars as a result of the delays. WFH is a creative roadblock, you miss out on hallway conversations and lose people sitting on a couch for an hour or two talking about something. You miss all the lunchtime banter. All of that goes away and becomes planned and more mechanical rather than natural.

We are all gamers

Many of us have some connection to the gaming industry. Worldwide, around 2.2 billion people play games on a regular basis. As of July 2018, there were an estimated 7.6 billion people on the planet, meaning that almost a third of the population is a gamer. 1.2 billion of the 2.2 billion gamers use a computer.

Because of its relevance to culture, entertainment and technological innovation, the gaming sector is considered one of the most exciting industries in technology. E-sports championships are expected to attract more than 70 million viewers in 2020. That is more than the NBA Finals, the NHL Stanley Cup Finals or the World Series. But breaking into the video game business is tough. For one thing, there are far fewer entry-level positions in the games industry than there are people trying to get them. The majority of people who get into game development programmers either don’t graduate or graduate but never work in game development.

On the other hand, if you’re willing to work hard both during and after your studies, you can ensure that you’re part of the minority who make it. A lot of people get into game development because they like playing games, but they’re not really passionate enough about making them to put in the hours. I’ve never met anyone who poured their heart and soul into making games and couldn’t get a real job out of it.

Poland, the new global center for gamers?

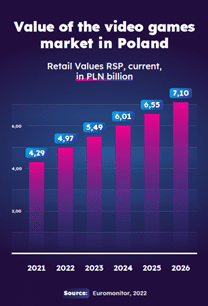

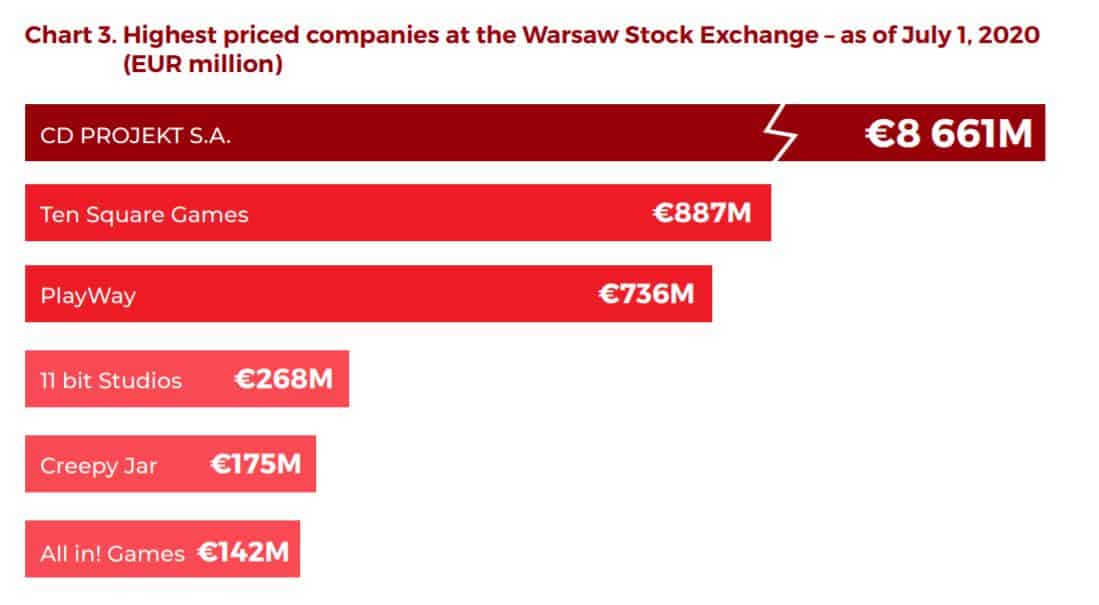

Is it hard everywhere? Apparently not in Poland. According to a recent estimate by the Polish Agency for Business Development, the Polish video games market is currently worth €470 million and is home to gaming giants such as CD Projekt, PlayWay, 11 bit studios and Ten Square Studios. 96% of games produced in Poland are exported.

In total, Poland has over 440 game development studios, producing everything from so-called AAA games (an industry term for games with the largest budgets) to indie efforts and smaller mobile games. These studios employ more than 10,000 people.

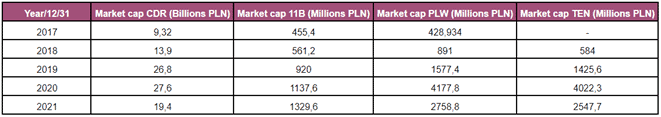

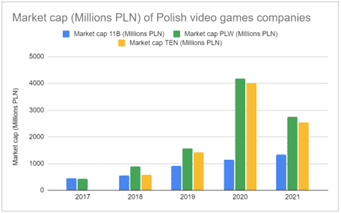

There are more than 400 video game development studios in Poland. As a result, there are many game professions to choose from. Only two companies, CD Projekt and Techland (Dying Light), are significantly responsible for the fluctuations in the revenues of the listed studios.

Another developer of excellent games from Warsaw, 11 Bit, is relatively small compared to these two, but on the rise and worth mentioning. They earned €7 million (PLN 30.5 million) in the second quarter of 2020 by selling more than 6 million copies of their latest games, This Was in Mine and Frostpunk. They have also just announced an investment of €18 million (PLN 80 million) in seven new projects. So keep an eye out! Most of the other developers mentioned are small independent companies making games on a shoestring budget, many of them free-to-play, and their income is more consistent.

Significantly, the game developers mentioned are global in scope. Foreign markets account for as much as 96% to 97% of their total revenues. In Poland, only around €6.9 million (PLN 30 million) is generated. It is worth noting that while PC and console games (and their add-ons) account for the majority of the market, spending on mobile, social and browser games is growing faster, helped by high mobile and internet penetration rates and the growing popularity of free-to-play games with paid add-ons. Their market share could soon overtake PC and console. Ten Square Games, based in Wroclaw, Poland, is a well-known studio specialising in hobby games, producing and publishing free-to-play games and earning money through micropayments (for access to paid in-game features) and advertising. Ten Square Games’ products are available on the most popular mobile platforms, including iOS and Android, as well as on websites. In 2019, the company had approximately €17m – PLN75m in cash, which gives them a lot of room for future business expansion and responding to possible business opportunities in the F2P industry. Its revenue in 2019 was €55m – PLN241m, up 109% from €26m – PLN115m in 2018.

The failure of CD Projeckt, Poland’s largest video game publisher

Yet, all is not well in Polish games. CD Projekt’s last big game, Cyberpunk 77, was a disaster. Two years after its release, the reviews are still very bad, with one user on reddit giving the following review:

My point in saying “it will never be good now” is due to people acting like this game has redeemed itself over the past two years because of dev support and patches, regardless of performance and bug issues game design wise. I really don’t think it has anything game design wise that lives up to the bare minimum of being an rpg or an open world game. This game falls apart if you try to scratch it more than an inch deep.

However, in a bid to redeem itself after its failure, CD Projekt has announced that work has begun on a remake of the first game in its flagship medieval fantasy franchise, The Witcher, on 26 October 2022. CD Projekt announced in April that the Witcher series, which consists of three games, has sold more than 65 million copies. The first game in the Witcher story, released in 2007, helped the company gain international acclaim. The game will be built from the ground up in Unreal Engine 5, using the toolset the studio is developing for the new Witcher series. The external studio Fool’s Theory, which specialises in role-playing games, is now working on the remake.

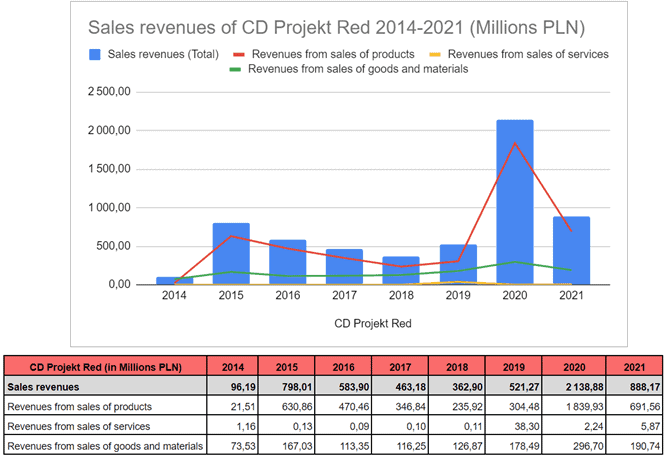

Graph above: it is worth noticing that Cyberpunk 2077 did not damage in depth the sales revenues of CD Projekt. Sales revenues in 2021 is way above 2019 figures and eventually top 2015-2016 sales revenues (The Witcher 3 and DLCs)

An increasingly tough domestic competition.

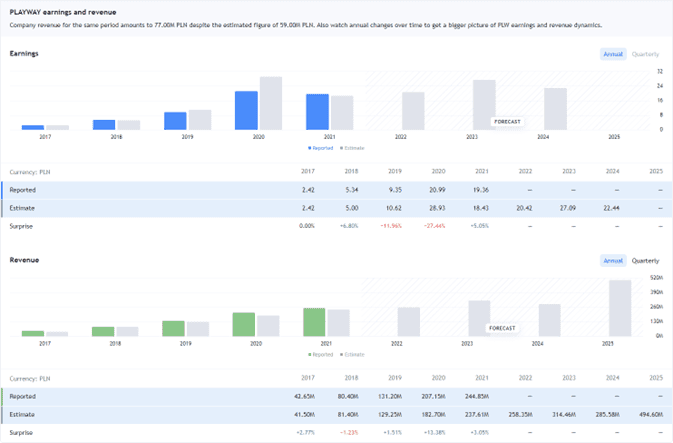

CD Projekt is not the only company competing with industry titans from China, Japan and the United States. Another major player is PlayWay, a company that contributes to the revenues of the Polish gaming industry. They are the second largest game developer and publisher in Poland and one of the largest in Europe.

They were founded in 2011 to support games created for platforms such as PC, iPhone, iPad, Xbox, PlayStation 3, PSP, Wii and Android. Their products are sold through STEAM, ITunes and GooglePlay, with the United States, China and Germany accounting for 60% of total sales. Since 2011, they have created and launched 70 games, with over 15 million downloads on PC/console and over 1 million on mobile platforms. Their ambitious goal is to produce at least 20 premieres per year, which they achieved in 2015. They are also the only Polish developer to have decided to open a unique campus for co-operating programming teams in Hornówek, which will enable successful collaboration of development teams by providing fantastic co-working space. So, if you are looking for different types of jobs in the video game industry in Poland and you are a passionate gamer with valuable market knowledge, PlayWay might be the right place for you to try your hand at social media jobs, where you can make a great contribution and spice up the life of the gaming community around the world. We could also talk about Esports and how Poland hosts one of the biggest Esports events in the world, the Intel Extreme Masters, which attracted a record 232 million viewers worldwide in 2019.

The WIG Gaming Index: the pride of the Polish economy

The gaming business is so important to Poland that the Warsaw Stock Exchange (WSE), the largest in the region, has dedicated an index to it in 2019, the WIG Gaming Index, as part of the exchange’s aim to attract technology companies. Listing regional gaming companies on the WSE is a brilliant strategy, it is a completely global play for Poland. Gaming is a global activity that takes place all over the world. The listing of these companies will probably continue to attract international investment to Poland.

By the end of 2020, the WSE will have the most gaming companies listed, with 54, surpassing the previous leader, the Tokyo Stock Exchange. This shows the importance of the games development segment for the Polish capital market and why the WIG Games Index was the correct move. Poland has become so successful that highly acclaimed titles from the country are no longer the exception, but the rule: rather than a one-off success, Poland’s creative industry is delivering a growing catalogue of highly regarded titles enjoyed by an international audience of gamers.

Games as literature and culture.

CD Projekt’s massive role-playing game The Witcher and 11 bit studios’ This War of Mine, a strategy game set in an occupied city (loosely inspired by the siege of Sarajevo) about ordinary people surviving against terrible odds, are both Polish titles that have sold millions of copies worldwide. It has become an indie darling as well as an essential entry in the canon of anti-war art. So essential, in fact, that it is currently being taught in literature classes in Polish schools. In an effort to make Polish history more appealing to younger audiences, this multi-platform video game, in which players become “heroes of Polish intelligence”, is being included in the national curriculum. For instance, Gra Szyfrów, set during the Polish-Bolshevik War and developed by the Office of Emerging Technologies at the Institute of National Remembrance (IPN), challenges users to decipher Bolshevik ciphers, protect radio communication cables and disarm an armored train.

What 11 bit studios have done with the game is perhaps one of the best proofs that success in the video game industry is about more than just money. Games are now a mainstream form of entertainment with a real creative currency, giving countries that do well the opportunity to export their culture to a global audience. It’s more than just economics. It’s about cultural heritage.

A foreign example, Grand Theft Auto, despite being based in the United States, has become part of the cultural heritage of the United Kingdom. Poland is proud of its games and believes that they are more than just entertainment.

Still a long way from international prominence

With more than 400 active game development studios (according to the latest industry figures) and almost half of the country’s 38 million people identifying themselves as gamers, analysts say the industry still has a long way to go. While in fact just a few years ago Poland played a rather passive role as a destination for outsourcing software development, it has now developed its own voice. Polish game developers have risen from humble beginnings to become a creative and cultural force.

But what do these achievements mean for the country as a whole, especially on the global stage? Will Poland now be recognized as a producer of quality video games?

An underfunded sector?

The video game business, like the medium itself, is fundamentally global, with more than 90% of games developed in Poland being played outside the country. The Polish government has recognized the potential for country branding and has allocated more than 300 million zlotys (around €66.7 million) through an EU-funded programmed to help small studios get their projects off the ground. Despite CD Projekt’s success and the sector’s prominence in the gaming world, Polish games have remained largely unnoticed by international investors for many years. This is despite other high-profile, venture-backed gaming successes in Europe, such as Finland’s Supercell and Turkey’s Peak Games, both of which were acquired by Zynga in 2020 for $1.8 billion.

However, both investors and Polish game companies may be rethinking their partnership. Local game companies have historically opted to raise funds on public markets rather than through private investors, even though public equities are currently underperforming. There are macroeconomic storm clouds on the horizon and a growing appetite for global consolidation in the gaming sector – imagine the American megadeals of 2022: Microsoft acquiring Activision Blizzard or Take-Two Interactive acquiring Zynga.

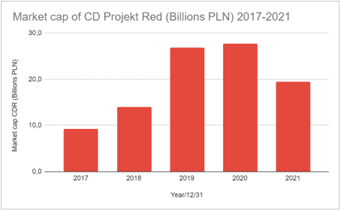

The 30-year history of Polish gaming can be traced back to two gaming titans, Techland and CD Projekt. The former is a privately owned, bootstrapped juggernaut that makes games like Dying Light and Call of Juarez and is reportedly valued at 10 billion zoty (€2.1 billion); the latter is the producer of The Witcher and Cyberpunk 2077 and was once Poland’s most valuable company. Its current share price is $3.11 billion.

Over the years, key employees and entire teams have broken away from these two major companies to set up their own smaller studios, creating an entire ecosystem of game startups. This is the story of 11 bit studios, considered by some to be the third largest player in the Polish game development scene. Its development staff used to work for CD Projekt. Konrad Tomaszkiewicz, lead director of The Witcher and producer of Cyberpunk, has just left CD Projekt to set up his own company, Rebel Wolves.

Despite this thriving business, several small game companies have opted to go public in recent years rather than seek VC funding. There are now 88 “game” companies registered on the Warsaw Stock Exchange (including its subsidiary for smaller companies, NewConnect). Many of them went public while CD Projekt was on the rise following the release of The Witcher and benefiting from its international success.

Back then, stock market investors were willing to put their money behind almost any company, even the most unusual, simply because it promised to produce a game – many of which turned out to be hollow promises. That gold rush came to an end on 10 December 2020, the release date of one of the most anticipated games in decades: CD Projekt’s Cyberpunk 2077. It quickly became clear that the game had been rushed, and many players, especially those on older consoles, encountered a variety of technical problems. The game was briefly removed from Sony’s PlayStation online store. CD Projekt’s value plummeted and has yet to recover. Naturally, this has affected investor demand for smaller gaming companies.

New alternatives for the Polish industrial market

The gloomy stock market may force entrepreneurs to seek alternative financing, while falling values may attract international investors. International investors have become increasingly interested in the sector in recent years: in 2020, Swedish video games company Embracer bought Polish studio Flying Wild Hog; in 2021, Chinese giant Tencent bought a minority stake in Bloober Team and then invested in Exit Plan Games in 2022; and in November 2022, another Chinese games company, NetEase, bought a minority stake in Rebel Wolves. International VCs were less visible: in 2022, Finnish VC Sisu invested in Exit Plan Games. Other, more unusual venture investments in the Polish sector were typically made by local firms such as Satus Ventures, SMOK or RKKVC.Yet that may be changing as well.

Poland, towards government support for the video game industry?

In 2019, Prime Minister Mateusz Morawiecki participated in Game Jam Square, an event where he met with developers and influencers, among others. The event is dedicated to game developers, game fans and business representatives. It aims to promote talent and the electronic entertainment industry. It is being held for the first time this year. The Prime Minister pointed out that the government is trying to support the gaming industry by creating programmes at universities, providing direct support and promoting gaming events. He added that it was a great idea to promote Poland.

Game Jam Square consists of team or individual creation of video games on a chosen theme within a given time limit. The competition is judged by a panel of judges in seven categories. The best teams will be awarded a Grand Prix and two equivalent prizes. In addition, e-sports fans can watch a tournament of the best Polish Counter-Strike: Global Offensive teams and visit the stands of gaming start-ups.

The maturation of the Polish video game industry is now a foregone conclusion. It is now up to all stakeholders to turn this recognition and market success into a true national brand that will take Poland to the next level of development and associate it with high quality digital entertainment. For the second time, Poland seems to be uniquely positioned to benefit from a perfect combination of innovative creatives, capital market backing and official support. When it comes to the consumer market in Poland, the country has 16 million gamers. This is more than half of the Polish population. Far from enough to cover all production.

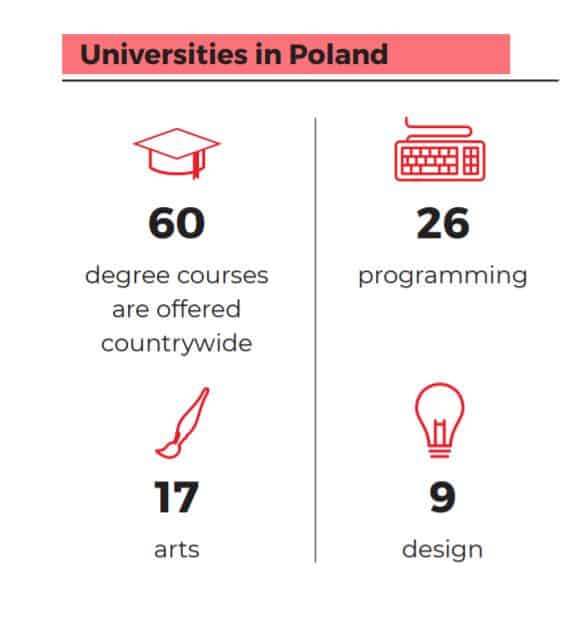

One of the reasons for Poland’s success in the games sector is the high level of mathematics in the education system, which results in a large number of highly talented programmers. Universities across the country are also driving the games sector – Polish universities currently offer more than 60 courses related to game development.

Working in this field requires the inspiration and collaboration of people with different skills. It offers many opportunities for professional and personal development. The specialization allows experts in the creation and implementation of digital games to obtain a cross-disciplinary and complementary education.

References

http://www.egdf.eu/wp-content/uploads/2020/09/PPE_PL_The-Game-Industry-of-Poland-report-2020v4.pdf

https://www.weforum.org/agenda/2022/07/gaming-pandemic-lockdowns-pwc-growth/

https://study.gov.pl/news/poland-leading-way-gaming-industry-how

Also read: